My 3 Worst Investments of 2022

Wallet/Portfolio Review (Week 13/52) - A Hawkish Dove is still Hawkish

📟 Disclaimer

I am not a financial advisor, and nothing I say in this substack is financial advice.

This is all educational content you can use as a starting off point for your own research initiatives. I’m just another random individual who started a substack ‘cause I think I have something to share with you all’. 🤷

That said, if you’d like to know a bit about me and are wondering why you should listen to me, read this intro post I wrote 🙌

📣 Weekly Highlights:

Last week I spoke about potential outcomes of a lower inflation print, whether that would green-light a .50Bps Hike instead of .75 bps.

Which, could lead to a market sentiment shift, triggering a multi-month up-trend (Essentially prices might go up until January).

However, Here’s What Actually Happened;

🤔 Inflation Expectation was 7.3%, we got 7.1%, Markets Rallied. Which was on par w/expectations but, short-lived!

On Tuesday’s inflation print was lower-than-expected, which perhaps marked a decisive down-trend in inflation, for the time-being, marking the May-June’s 9.1% inflation print as peak inflation.

However, the average joe today, still feels the crunch more than ever.

Perhaps people thought the Federal Reserve will be lenient with interest rate hikes and might consider shifting from Quantitative Tightening to Easing.

However, Post FOMC, the markets dumped and hopes of a Sanata Rally are now looking quite bleek.

🤔 What went wrong?

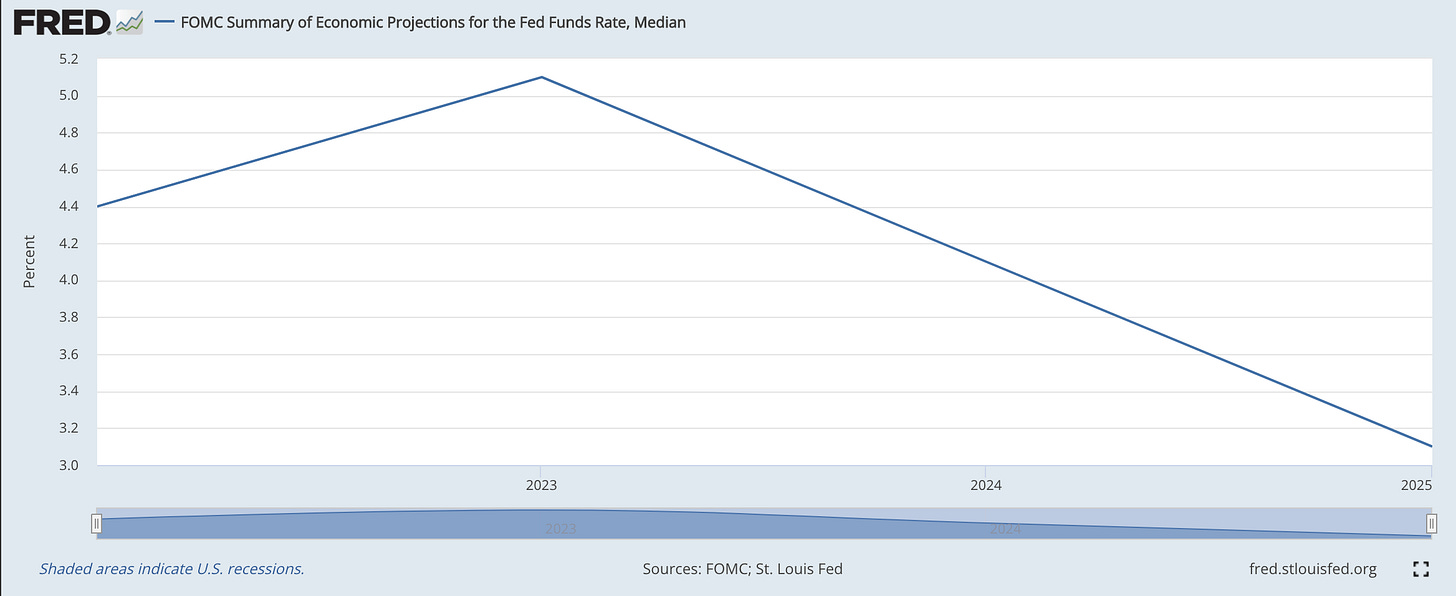

When Jerome Powell spoke with reporters and journalists post FOMC. The Hawkish Tone was persistent. The Terminal Federal Fund rate is now estimated to be as high as 5.1% - 5.25%.

In accordance with their Economic Projections, they expect to hike rates all the way up-to 5.1% and hold there for the remainder of 2023, with rate cuts beginning late or early 2024, and they expect to cut rates by .200bps bringing it down to 3.1% by End of 2025.

This New-Found Poker Face Hawkishness spooked the markets and the one thing investors hate more than anything is uncertainty.

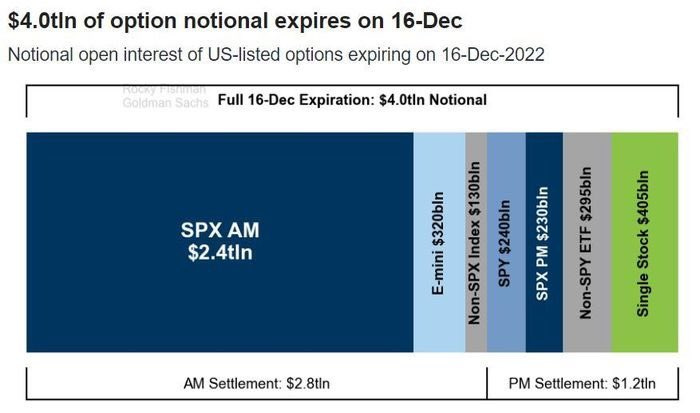

Pair that with a 4 trillion options expiration, year end tax-loss harvesting, ETF Rebalancing and profit taking, you have the perfect recipe for killing any/all bullish momentum.

Having said that, I think the vast majority of that capital will be reallocated back into the markets, cause smart money is making big moves again.

To be absolutely honest, this new found hawkishness of FED might be a pipe dream, the federal reserve has a history of being “behind-the-eight-ball” and a vast majority of indicators (primarily the inverted yield curve) has been predicting a recession since mid 2022.

This could lead the fed to U-turn completely and Cut rates again by .400bps by Mid-late 2023.

⏩ So, What’s Next?

As of now, it’s difficult to say what will be the outcome of all this new-found fear but, it’s sufficient to say, all hopes of a Santa Rally have now eroded (i.e., no Price Increases, instead prices might fall further).

All in all, my strategy last week was based on a softer inflation print, leading the FED to reduce the pace of rate hikes, starting with a .50bps hike this month.

Which all came true and we had an up-market on Tuesday but, as soon as Wednesday rolled around and FOMC decision for a .50bps hike was broadcasted, the markets started dumping immediately.

There’s fear around Binance’s proof of reserves, trad-fi newbies that got swindled by SBF are projecting their FTX anxiety on CZ and binance.

Some folks are bringing to light justified Fear Uncertainty & Doubt that will need answering. Where there’s smoke, there’s a fire right? (I’ll report in detail if true.)

Here’s Binance’s Nansen Dashboard showing all their assets (Around $54 billion at the time of writing this post)

However, it’s important to consider the fact that FTX’s balance sheet was primarily FTT Tokens & Potatoes. Binance actually has various assets and large stable-coin reserves, as illustrated above.

So far, Binance has handled the stress test quite well (Approx. 10B worth of withdrawals).

To Top it all, their Auditor Mazars, decided to Leave Crypto completely. Leading the vast majority to speculate that Binance’s audit is as bogus as FTXs audit and nothing can be trusted.

Of-course anything can happen, nothing is for sure/done-deal and you should take your assets off exchanges as soon as you’re done buying the said assets and use Defi as much as possible. That’s essentially the whole point of this substack (JIC you are new here).

As it stands now, I’ll observe the markets for the week and perhaps do my best to setup my positions for a down-trend. Drop my wallet a follow on Debank to get updates in real-time. The Lesson we learn’t this week was;

Markets Can/Will Remain Irrational Longer Than You & I Can Remain Solvent.

👛 Wallet Review

This wallet review is a recurring post. The aim is to post an official update every Monday and see how far I can grow this little stash by week 52.

As of December 19th, 12:00 UTC this tiny stash of mine sits at a modest value of $740 USD, dubbed week 12 closing balance & week 13 opening balance.

This week, in the spirit of transparency and honesty. I’d like to talk about my three worst investments of the year 2022.

🏅 My 3 Worst Investments in 2022.

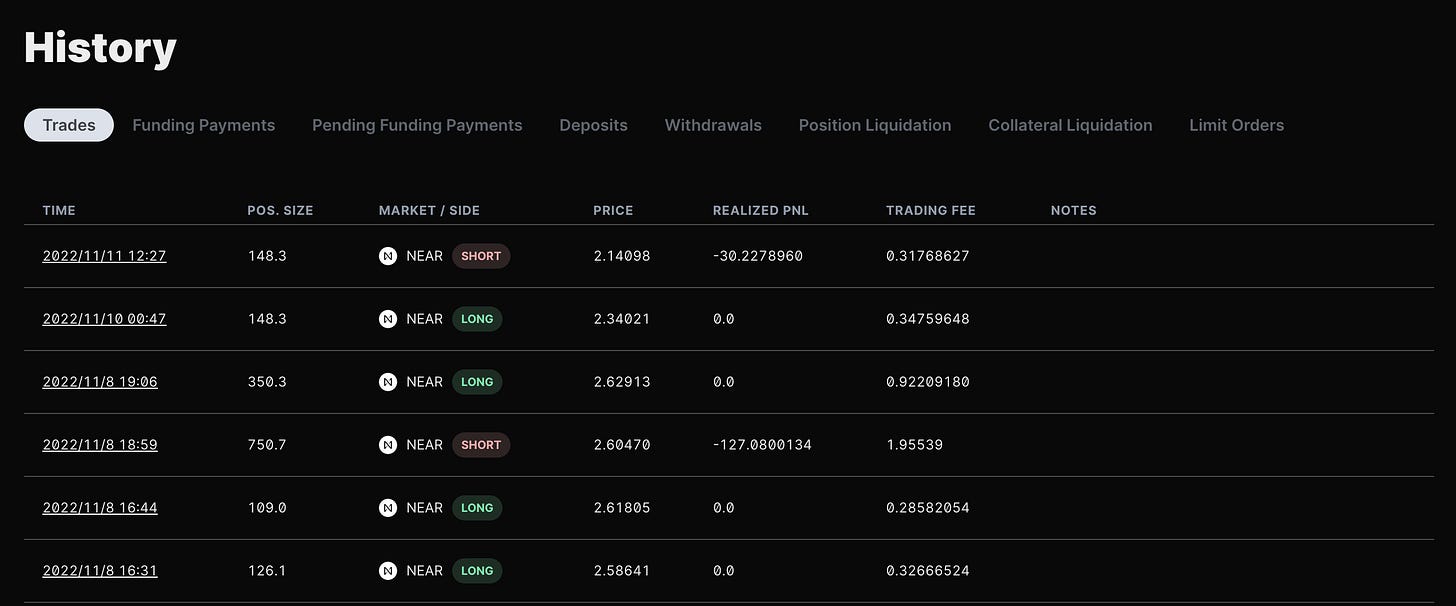

💚 Trading on Perpetual Protocol (Lost $160 Leverage Trading)

⛓️ Aurora/Near (Lost $25 (50%) of my investment)

🏦 Aurora Ecosystem Projects (Tri-solaris & Aurigami)

💚 Trading On Perpetual Protocol

I lost the a lot of capital “Building a Position” on a NEARPERP Swap on Perpetual Protocol, the week of FTX Collapse (November 7th).

Do not get me wrong folks, I could’ve hidden my losses and just lied but, I want you guys to see how these events can wipe out months of gains in days.

It was borderline embarrassing, to loose $158ish dollars, just leverage trading.

but, I hope maybe you all can learn from my mistakes and use this as a back-test for your own mental models.

NEAR Protocol was part of the FTX/Alameda Portfolio, Like Solana & co., Near fell significantly and in trading you call this catching a falling Knife 🔪

Lesson learned:

Instead of chasing it all the way down -80%, Perhaps one should, accept a 20% loss and wait, preserve their capital, let the fear settle as too many panic sold for very little cause as DeFi is still running as built. It was centralized entities/actors that caused this and failed the industry. Again!

⛓️ Aurora/Near (Lost $25 (50%) of my investment)

On September 26th, i invested in Aurora and wrote about it in my Week 1/52 wallet review. At that time, the value of my aurora tokens was $14 (as seen in the image below, from week one’s post).

As of today, December 19th, 2022, those tokens are now valued at just $3. That’s a significant hit (-69.420% give or take 🤣).

I mean I have earned some tokens for staking my Aurora Coins but, none of those are worth more than a single penny.

Selling these now, doesn’t make any sense to me as from my perspective no fundamentals have changed. It’s just market sentiment causing volatility.

🔗Trisolaris LP Positons:

The same goes for my Trisolaris LP positions, when I invested into these LP pools (September 2022), the value of my supplied assets was $15.

As of today (December 19th, 2022). These assets have fallen to $6. Part of it is the FTX debacle & other part is lack of on-chain activity/adoption for the NEAR Token.

Bringing the total amount of losses, from bad investments to Approx. -$185.00.

To be absolutely honest, given what’s going on in the market and how tight financial conditions are affecting everything, things could’ve been much worse.

Diversification of capital into various strategies helped me reduce my risk exposure.

Of-course having little capital spread across various investments/use-cases will reduce the full-fledged upside potential of my portfolio, as I didn’t bet big on my winners/best-performers.

However, it’s important to remember, no one can get straight A’s or pick pocket aces every round.

In times like these, your best performers help offset the losses from your worst performers.

Does it suck to have made bad investments? 100% no denying it! But, investing is a marathon, not a Sprint.

An Average investor expects 4/10 of their investments to go to zero or yield underwhelming returns.

🪤 Outro

Of course, it goes without saying but bears repeating that nothing I say or share here is financial advice. I’m just another random individual starting a substack ‘cause I think I have something to share with you all’. 🤷

Also, like many individuals who are doing this for a living I also am a humble penniless fool. So, if you are a kind, bountiful, and gifted individual who has benefited from this S#!t Postery and wish to buy this S#!t Poster of yours a coffee, Some drip money would definitely be appreciated and will help to keep my fingers going on this mechanical keyboard of mine.

You can donate whatever you think is right at this address: shitcoinornot.eth :)