In today's episode, we're going to talk about Gary Gensler's recent congressional hearing and how he's trying to regulate the crypto industry with draconian ideas that will drive innovation out. In other news, it seems like Bitcoin and Ethereum had a bit of a tiff last week.

📟 Disclaimer

I am not a financial advisor, and nothing I say in this substack is financial advice.

This is all educational content you can use as a starting off point for your own research initiatives. I’m just another random individual who started a substack ‘cause I think I have something to share with you all’. 🤷

That said, if you’d like to know a bit about me and are wondering why you should listen to me, read this intro post I wrote 🙌

↪️ Last Week’s Recap:

⚖️ Gary Gensler’s Congressional Hearing Re-cap:

Republicans have accused Gensler of overstepping his bounds and failing to effectively regulate the crypto market.

Gensler, on the other hand, defended himself by arguing that the industry is rife with securities law violations.

During the hearing, Rep. Patrick McHenry challenged Gary Gensler’s approach, arguing that many crypto firms don't know which laws apply to them, and the SEC's enforcement efforts have been "nonsensical."

Maybe the SEC needs to come up with a "Crypto Law for Dummies" edition.

Gary responded by insisting that the law is clear, but many crypto firms simply don't want to comply. Oh sure, the law is clear as mud.

And it's not like the crypto industry is constantly changing or anything.

The SEC Chair's focus on regulating the trading platforms of unregistered securities has drawn criticism from the crypto industry, which argues that it's unclear how these laws apply to cryptocurrencies. It's like trying to fit a square peg in a round hole. It just doesn't work.

During the hearing, McHenry raised the question of whether Ethereum ($ETH) is a commodity or a security, and Gensler tried to answer indirectly. Of course, he did, because if he answered directly, he would have to admit that he has no idea what he's talking about.

Meanwhile, other Republican lawmakers have taken a harder line against Gensler, accusing him of failing to protect investors and allowing fraud to occur under his watch. Rep. Tom Emmer referred to Gensler as an "incompetent cop on the beat" for failing to stop fraud in the crypto industry. Ouch, that's gotta hurt, Gary.

Rep. Warren Davidson went even further, introducing legislation to remove Gensler from his position as SEC Chair. Davidson criticized Gensler for his overreach and argued that the SEC needs to be restructured. Maybe it's time to admit that Gary is not the guy for the job. It's like putting a square peg in a round hole, again.

📰 In other news

It seems like Bitcoin and Ethereum had a bit of a tiff last week. According to CoinShares, Bitcoin had a $53 million outflow while Ethereum had a $17 million inflow, after its recent Shapella upgrade.

Apparently, the outflows for Bitcoin were a result of profit-taking after the digital asset reached the $30,000 price plateau. That's right, it looks like someone wanted to cash in and buy that Lamborghini they've been eyeing.

But don't worry, it's not all doom and gloom for the crypto world. Despite the overall outflows of $30 million last week, Polygon managed to snag another $1 million in inflows.

Looks like the crypto market is still chugging along, even with a few bumps in the road. Let's just hope that Gary Gensler doesn't try to regulate the fun out of it.

📟 Portfolio Activity Review

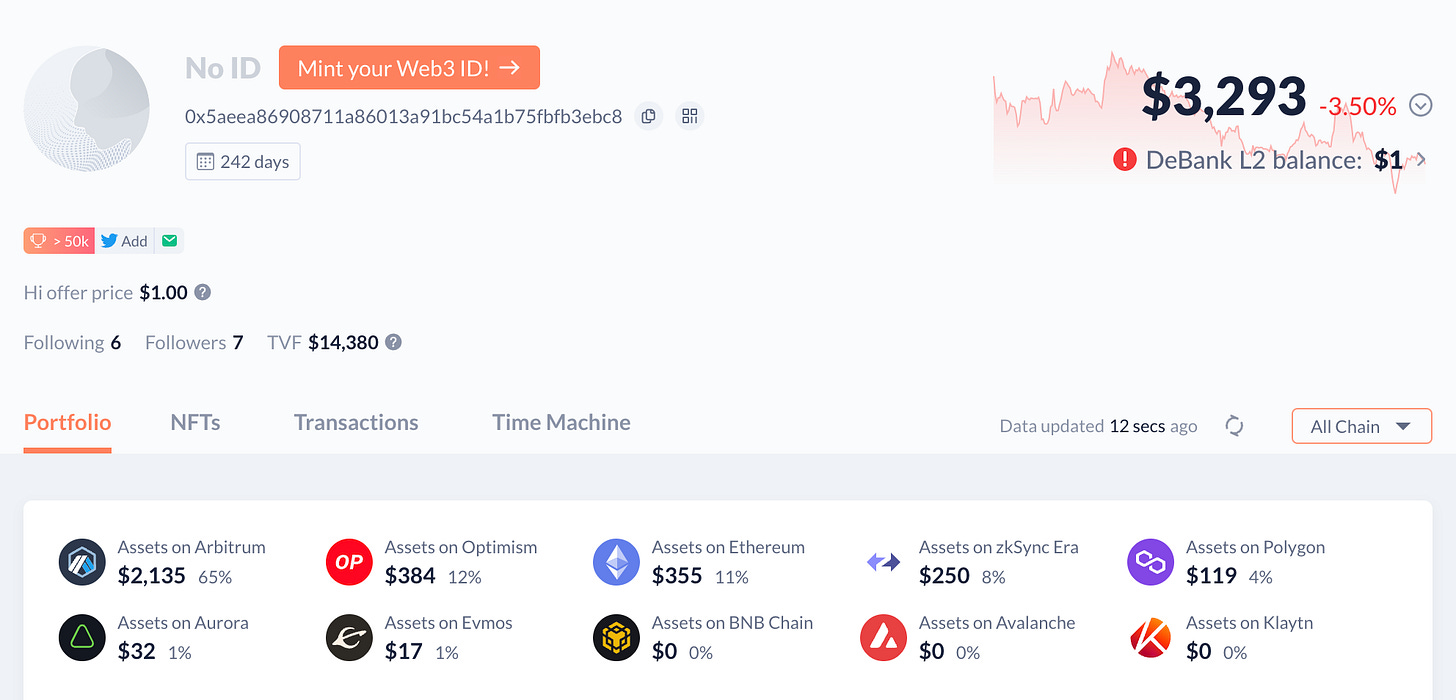

As of April 24th, 16:00 UTC this tiny stash of mine sits at a modest value of $3329 USD, dubbed week 31 closing balance & week 32 opening balance.

Week Zero(0) Opening Balance Was: $450.

I'm feeling pretty damn proud of myself right now. You see, I took about $700 in profits last week, and boy am I glad I did.

But the biggest thing I did was move over about $450 worth of liquidity to ETH main-net to jump on the PEPE token meme train.

I mean, who doesn't love a good meme, right? And with all the hype around PEPE, I just had to get in on the action.

So I opened up an LP pool on Uniswap with PEPE and ETH tokens, not just to capitalize on the price, but to also take advantage of the increase in hype and pool activity I'm anticipating.

I say that because the MarketCap is already around 110 million, maybe the most it’ll get to is $1 billion and that’s extreme hype territory.

MEME coin rallies are usually leading indicators of tow things; the marching shot of a bull-market or the Final bell of a bull-rally, what can it truly be? Who knows? Maybe I'll strike gold and make a fortune. Or maybe I'll lose everything. But hey, at least I'm having fun with it!

DISCLAIMER: This content is for educational and entertainment purposes only and does not constitute financial advice.

This is simply an exploration of DeFi and an experiment documented for entertainment purposes.

🪤 Outro

Of course, it goes without saying but bears repeating that nothing I say or share here is financial advice. I’m just another random individual starting a substack ‘cause I think I have something to share with you all’. 🤷

Also, like many individuals who are doing this for a living I also am a humble penniless fool. So, if you are a kind, bountiful, and gifted individual who has benefited from this S#!t Postery and wish to buy this S#!t Poster of yours a coffee, Some drip money would definitely be appreciated and will help to keep my fingers going on this mechanical keyboard of mine.

Share this post