🤌Intro & Disclaimers

I am not a financial advisor, and nothing I say in this substack is financial advice.

This is all educational content you can use as a starting off point for your own research initiatives. I’m just another random individual who started a substack ‘cause I think/hope/know… that I have something to share with you all’. 🤷

That said, if you’d like to know a bit about me and are wondering why you should listen to me, read this intro post I wrote 🙌

🌊Let’s dive in:

This wallet review is a recurring post. The aim is to post an official update every Monday and see how far I can grow this little stash by week 52.

As of September 19, 00:00 UTC this tiny stash of mine sits at a modest value of $450USD, dubbed week 0 closing balance & Week 1 opening balance. (up $4.00 from last week, which is not all that bad given last week was quite brutal for the markets. Federal FUD rate was hiked by .75bps)

For illustration purposes, I’ve dropped a screen-cap of my wallet,

accessed via debank.

As of 00:00 UTC September 19th, 2022, My wallet has active interactions with these projects:

🌐🔗Treasure.lol,

🌐🔗Chain Link,

🌐🔗GMX,

🌐🔗Livepeer,

🌐🔗JonesDAO,

🌐🔗Sperax,

🌐🔗Hop.exchange (WETH/HETH LP) (How to Add Liquidity on HOP)

🌐🔗PlutusDAO,

🌐🔗Vesta,

🌐🔗⚖️Balancer Pool

🌐🔗🦄Uniswap (OP/PERP Liquidity Pool)

🌐🔗Thales (options trading)

🌐🔗Aurora Plus (Read My review on what is Aurora+)

🌐🔗Aurora Plus (Read My review on what is Aurora+)

🌐🔗Aurora Plus (Read My review on what is Aurora+)

🪙 Assets I'm holding in my wallet:

🎖️ With my Top 5 idle holdings being:

USDC (50.78|$50)

sUSD (25|$25),

AETH (.0112|$16),

OETH (.0100|$14),

Link (.7749|$6).

That’s just what I’m holding. I am not actively trading at the moment. The remaining vast majority is just crypto dust. Crypto dust is simply a trace amount of cryptocurrency that’s leftover after a trade or transaction (Gemini, 2022).

🕵️ Now let’s look into some defi strategies I have on the go.

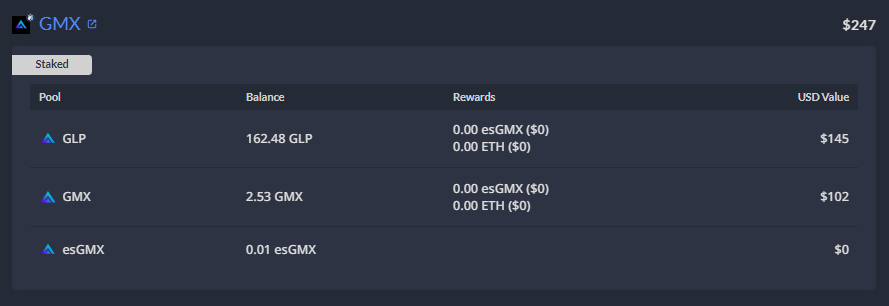

🔗GMX

As you can see, I’ve got some GLP (162.48|$145) & GMX (2.53|$102) Tokens Staked that are earning me 16.27% & 30.20% respectively. More in-depth details about these tokens can be found in the image below.

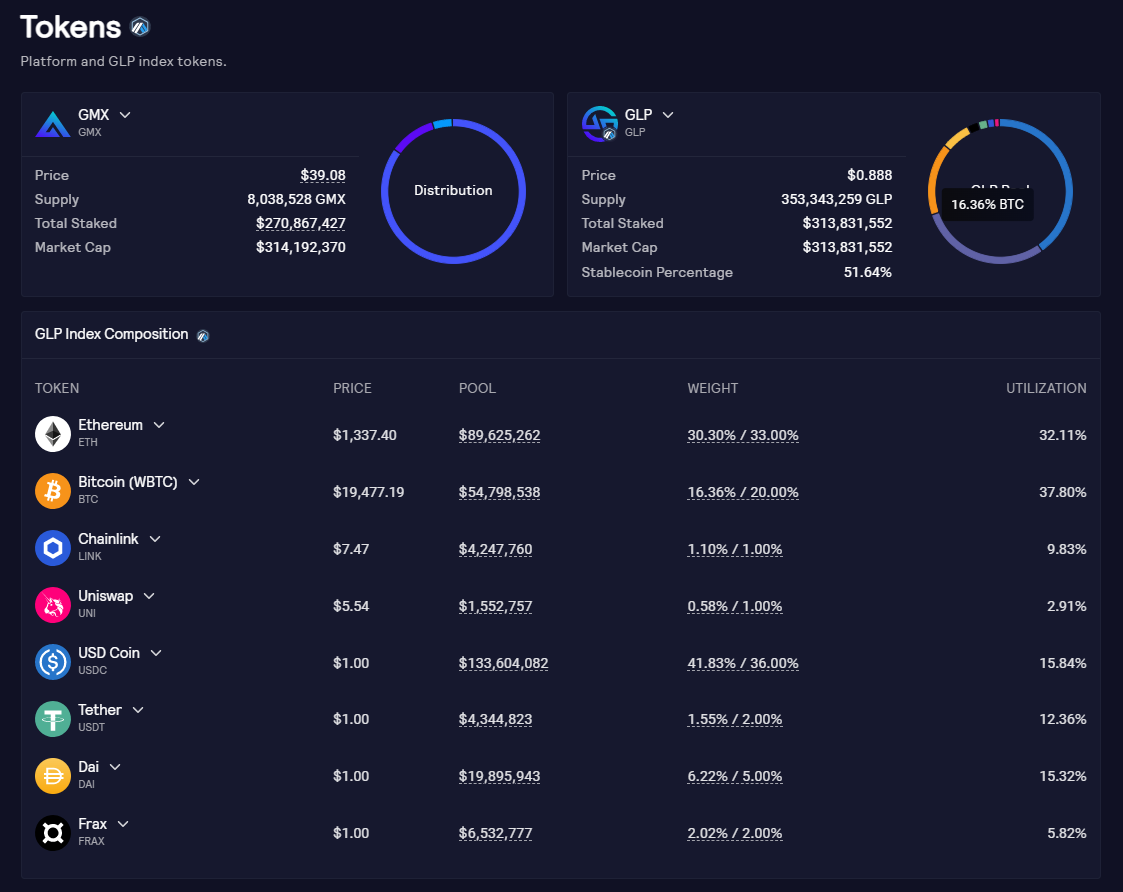

I encourage you to read up a bit more about the GLP Index Composition. It’s essentially an index fund containing Bitcoin, Ethereum, ChainLink, Uniswap, USDC, Tether, Dai, Frax.

Simply speaking, buying this one index gives you exposure to 4 Crypto Currency Assets and 4 different stable coins, currently amounting to 51% of the GLP index.

Also, here’s some more in-depth details from my personal GMX dashboard:

This screenshot above gives a breakdown of GMX I have staked, how much it’s yielding me, and how much rewards I have ready and available to claim. As I claimed some rewards last week, I’m going to forgo the claim for now and grow my multiplier :)

And just in case you are wondering if there’s similar details available for my GLP, yes there is (screen-caps below):

🔗Mycelium(Formerly Tracer DAO)

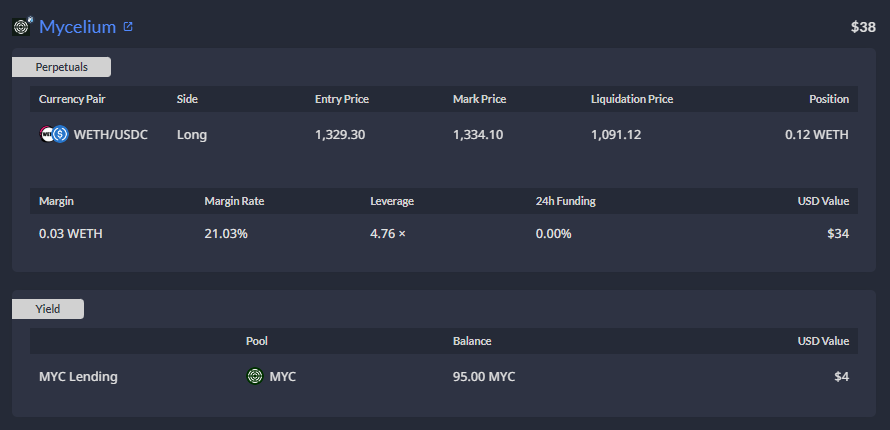

The next strategy is a long position on ETH (Opened on Sep-18-2022 09:37:17 PM +UTC - Here’s the transaction on Arbiscan).

As you can see in the screenshot above, the position size is 0.12ETH ($160). Leverage is at 4.76x (max leverage one can take is 30x) with my underlying collateral being $34 worth of ETH (.03).

This gives me an entry price of $1,329.29 and liquidation price of 1,091.12.

This position is technically in profit but not a profit of any significance.

Some Context for you:

Mycelium was formerly know as tracer. Not gonna lie, this new version looks a lot like GMXs UI (perhaps it’s “Heavily Inspired”). Regardless, Love the Initiative! I have 100 Tracer tokens sitting in my wallet, that needed to be swapped 1:1 for MYC tokens as part of the migration.

ETH has just dumped to $1330

This time last month, ETH was trading between $1900 to $2000. Needless to say, the RSI at that time was over bought on multiple time frames (1H/4H/1D).

Today, I’m inclined to believe we are hitting oversold on those similar time frames mentioned above.

Can the price fall further? Likely.

In the coming days, I will decide if I should close this position

(i.e, cut my losses and move on) and wait for a better entry.

Or, I can look at technicals & fundamentals, keep an ear for catalysts (FOMC meeting maybe?), and decide if i need to build a position and possibly, ride a trend until it reaches oversold.

As of yet, not sure! If you monitor my wallet, chances are, you’ll know before most do.

🔗Hop Protocol

If you aren’t familiar with Hop, it’s a cool protocol that allows us to bridge assets like ETH, USDC, USDT, DAI MATIC between Ethereum, Polygon, Arbitrum, Optimism, Gnosis.

As you can see, I have $28 worth of Ether split roughly 50/50 between WETH/hETH. They are both ETH and roughly track the same price. You can say they are ETH with task specific upgrades. ETH as an asset cannot interact with other tokens on it’s own. It needs to be wrapped (read up about wrapped ether here, and what wrapped tokens mean).

Think of hETH as hopper’s version of ETH modified with a simple layer on top, so it can perform tasks specific to hop protocol. I can use hop’s app (linked above) to convert my wETH to hETH and supply a roughly 1:1 ratio of the tokens in their AMM (Automated Market Maker) pools. Once I add my share to the liquidity pool, those assets start earning a portion of the fees collected by the bridge.

🔗Uniswap

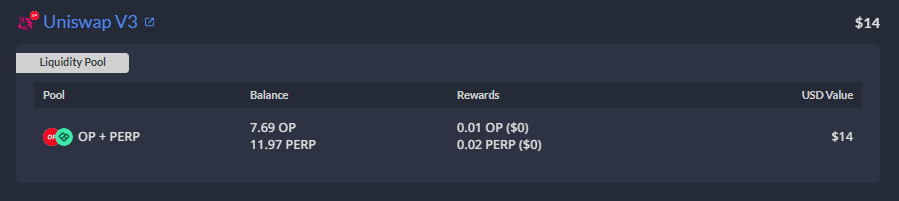

I received some OP and PERP tokens on optimism.

As part of OP summer, Perpetual Protocol was running an OP summer Pool Party

I had supplied some liquidity to Perpetual Protocols’ NEAR/VUSD and PERP/VUSD pools In the recent past, and these are the leftover rewards so I figured I’d just drop them in an LP pool and let them trade against each other for an eternity or two.

Here’s my uniswap V3 NFT dashboard so you can see the price range conditions I’ve set (i.e., I’ll earn fees, only when OP/PERP trade against each other in the specified price range)

🔗Thalesmarket

You can call these parimutuel markets, prediction markets(options trading), above is the history of my buy orders on thales markets. I recommend you checkout “Tale of Thales” if you want a quick and dirty yet entertaining nostalgic crash course on options trading.

I was experimenting with their ranged markets and below is a screen-cap of my matured positions, with total profits and gain.

My first position was essentially a ranged bet of $10.00;

Ether will trade between $1350 to $1750,

On it’s maturity date: Sep 2nd, 2022,

Upon successful maturity i was able to claim $14.09 (40.9% profit).

I then invested $18.37 in another ranged market;

Ether will continue trading between $1350 to $2100

On it’s maturity date: Sep 17th, 2022,

Upon successful maturity i was able to claim $25.01(36.1% profit)

You’ll quickly start realizing %s matter more than $$, however, this last one was a close call. My aim is to grow my initial $10 sUSD investment as much as realistically possible and collect a portion of profits for myself as often as possible.

Feel free to drop some comments below to let me know your thoughts.

Perhaps there’s something you think I could do to improve my strategies?

Anything you’d like me to experiment with for the next review? Yada Yada, you know the drill.

Outro

Of course, it goes without saying but bears repeating that nothing I say or share here is financial advice. I’m just another random individual starting a substack ‘cause I think I have something to share with you all’. 🤷

Also, like many individuals who are doing this for a living I also am a humble penniless fool. So, if you are a kind, bountiful, and gifted individual who has benefited from this S#!t Postery and wish to buy this S#!t Poster of yours a coffee, Some drip money would definitely be appreciated and will help to keep my fingers going on this mechanical keyboard of mine.

You can donate whatever you think is right at this address: shitcoinornot.eth :)

👛 My Debank Wallet (shitcoinornot.eth)

If you are interested in tracking my wallet and seeing what I’m doing and how I am navigating in this “Web3 World” feel free to follow me on debank.com.

It’s the best portfolio tracker (in addition to Zapper & Zerion) to track crypto portfolios. Think of it like a summary of your holdings and investments.

Every Monday, I’ll do an update on my “Holdings” documenting my decision making and rationale behind the projects that are in my wallet so be sure to come back next monday!