📣 Weekly Highlights:

Last week we spoke about;

Outcomes of a Lower than expected Inflation Print,

The year end 4 trillion Options Expiration,

Binance FUD, Mainstream Media Angsty-teen-tantrums & what to expect next.

📟 Disclaimer

I am not a financial advisor, and nothing I say in this substack is financial advice.

This is all educational content you can use as a starting off point for your own research initiatives. I’m just another random individual who started a substack ‘cause I think I have something to share with you all’. 🤷

That said, if you’d like to know a bit about me and are wondering why you should listen to me, read this intro post I wrote 🙌

I could Talk about the SBF 250 Million Bail Bond! and, Binance Fudders being silenced. Again. But, I figured, ‘tis the season, this week in the markets was let’s say relatively stable.

$BTC will on occasion become a stable coin, and just trade sideways in a tight range.

On the daily TimeFrame, since the FTX Debacle (November 8th); we’ve traded in this tight range of $15,452.01 to $18628.65.

With the Vast Majority of time spent in the $16500 to $ 17900 range.

And over the last few days, it’s been quite difficult for the price of BTC to decisively break above $17000, and crash below $16500. We’ve been trading for days in a very tight price range ($500).

We can Chalk this up to; less market participants, low volume, Holiday season, etc…

However, i’m of the impression that a strong accumulation is underway!

Regardless, We will see a decisive break up or down within the next 2 weeks!

Meaning; we’ll either break 20K and start a new trend (or) Fall/Capitulate to the $12K mark like everyone’s been predicting.

Why Am I Anticipating a strong move in the next 2 weeks?

Cause January 12th is the Next CPI (Inflation Print). If it goes up, we’ll fall further, if it falls further, we’ll rally until the FOMC meet in Feb 2023.

👛 Wallet Review

This wallet review is a recurring post. The aim is to post an official update every Monday and see how far I can grow this little stash by week 52.

As of December 26th, 12:00 UTC this tiny stash of mine sits at a modest value of $740 USD, dubbed week 13 closing balance & week 14 opening balance.

I haven’t made a single transaction since last week so there’s not much new to report here. However, in last weeks review I only mentioned my 3 worse investments and didn’t mention anything about what i picked up during this fire sale!

🦄 ETH/USDC Uniswap Liquidity Pool

Firstly, as you can see above, I exited my ETH/USDC Liquidity provider position, to allocate the (USDC) from that position to buy coins I’ve been eying (Stargate.finance, Mycelium.xyz & Radiant.Capital)

Please use the provided Hyperlinks or search for these projects on Coinmarketcap & Coingecko to access the correct/real links, Please practice reasonable skepticism and beware them scammers)

✴️⛩️ Stargate.Finance

First i used some of the USDC 40/98 to buy 100.98 STG tokens (as illustrated in the transaction log above). then staked & locked 65/100 STG until 10/2025 and collected the 0.42USDC(42 cents) my staked tokens had collected in bridging fees.

Note: I already had 35 STG staked from my initial buy, in October 2022, which i increased by 65 bringing the total to 100 STG Staked & locked until 2025/10/29.

And of-course, i’ve also provided some of my ETH to their ETH pools on Arbitrum. Essentially i have fronted them some of my ETH to use for processing asset transfers across chains efficiently. In-exchange for loaning my assets the protocol provides me rewards in STG tokens (around 3% per annum atm, this rate varies ofcourse).

Point being; one shouldn’t just buy and hold inflationary tokens. Specially If you’re aware of said token’s inflationary Tokenomics.

As i’m aware of the fact that the token supply will increase significantly over the next two years (illustrated above by token emissions and investor unlocks above), and that we will remain in this bear/sideways chopp-ish, low trading volume env for the next six months.

Even a fool such as myself can conclude STG has massive downward price pressure coming it’s way starting feb-march. If I’m expecting relatively low demand & high sell pressure, buying as the price falls each month, doesn’t make sense. But, it’s no guarantee price will fall for sure (90% sure it will but, maybe it’s different?)

What i can do is, ease in my buys (meaning; separate in various block orders over Quarters) & find ways to farm the token with existing assets (the beauty of DeFi 😘).

Of-course over the long-term (5 year: set it & forget it strategy.) it won’t matter as much. But, from a trader’s perspective, it’s an arbitrage opportunity i’d be leaving on the table if I didn’t include farming with existing assets as an accumulation strategy!

I took the remaining STG tokens (35/100) and approx. $5ish buckaroos

And opened a USDC/STG Uniswap LP position.

Here’s the Price Range I’ve set for this LP:

.20cents to 10.0975 price range.

Meaning, if the price of STG falls to .20cents, my entire LP position will become an STG position. Vice-versa is also true.

If the price of STG were to climb all the way to $10.0975. My entire LP position would become USDC.

As-Long-As the price trades in this range, my LP position will also accumulate extra fees in USDC and STG tokens everyday and store it separately.

Quick Note:

Each time you open a Uniswap LP Position, you get a unique position price range specific NFT.Essentially, your assets are store inside this NFT, which resides in your wallet. With permissions to uniswap protocol. For accessing your assets for pool specific requests.

Which is super-cool! You’re NFT is not just another picture of an Ape. Instead it’s a super useful tool!

And stored inside of this NFT are few separate wallets for position management. Secondary wallets, Which store your share of rewards from fees collected. Also Note: I’ve grossly over-simplifying how the tech works in the back-end.

I can claim these coins/tkns anytime. They accrue continuously and just accumulate as long as my LP position trades in the active price/trading range.

🏦 Mycelium

I have personally used Mycelium products; Perpetual Swaps, and, MYC Staking. There’s also Perpetual Pools - If you like to buy (n)xshort, or, (n)xLong, type of leveraged synthetic positions, etc…

I’m quite fascinated/intrigued by how well the reward mechanism alongside the fee accrual model fit’s into the Real Yield Narrative. Here’s more info and “how-to” bits for LPs.

I’ve been using mycelium ever since I started this wallet review, if you don’t believe me, you can check Week 1/52 of this wallet review below:

Having said that, Mycelium is, let’s say, My Favourite S#!T Coin.

Yes It’s UI looks a bit (maybe a lot) like GMXs.

But, that’s not a bad thing, trading is a repetitive task, it’s difficult to teach a user new tool when the goal is to provide better execution and experience.

So leveraging an industry standard interface with some UX tweaks of your own on top is a good idea. End of the day, it’s a functioning, well-oiled machine.

All contracts execute, UX is definitely improving day-by-day, Project Founders are OGs, Arbitrum & ChainLink Node Operators!

Essentially, they are here to build products that solve problems for masses and are likely in it for the long run. At-least for now. I’ll report if otherwise of-course! Trust But, Verify! Do not YOLO your money on this! It’s maybe like, throw $50, stake it and forget it! Type of deal.

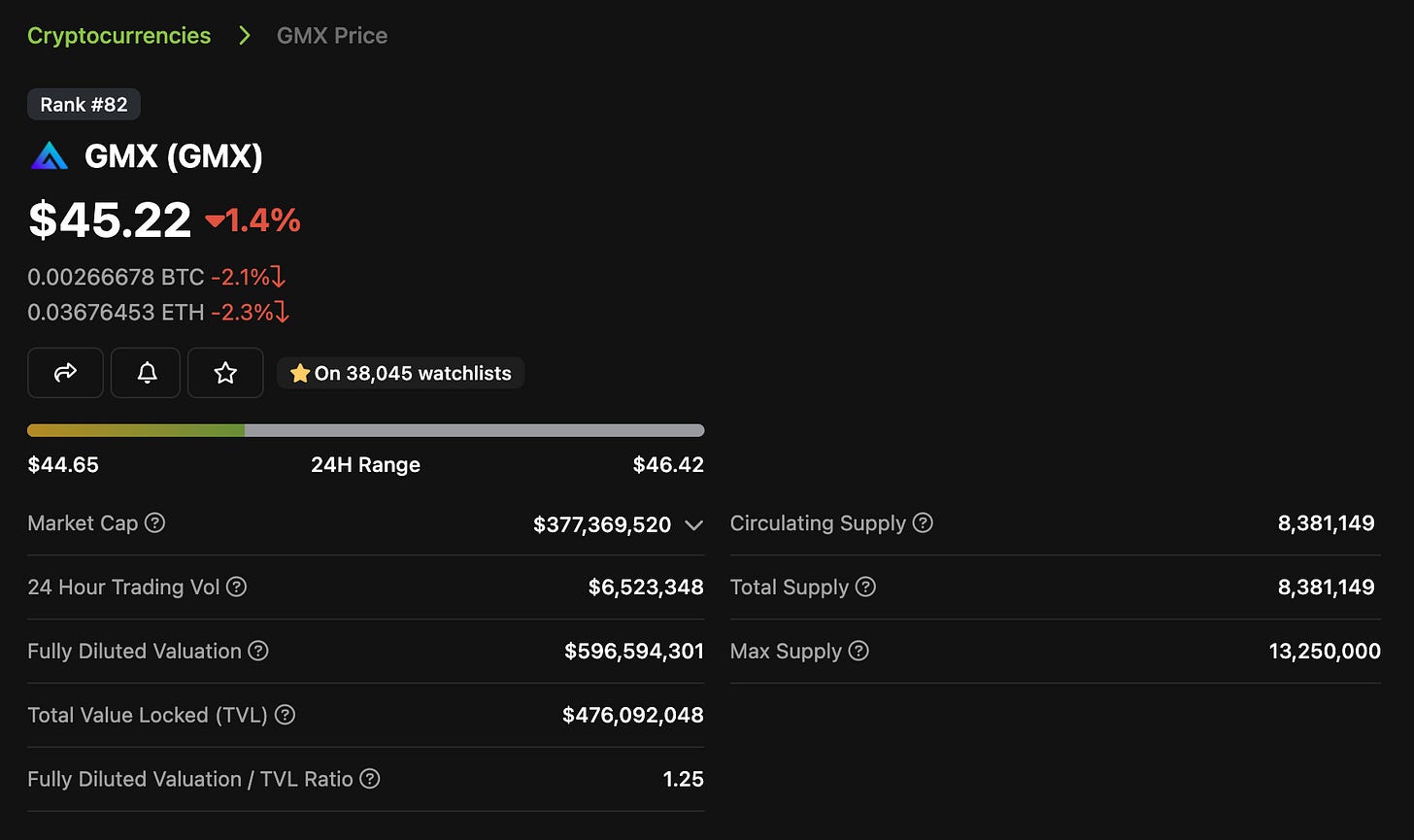

As you can see on CoinGecko, this project’s market cap is $6ish Million. Needless to Say, It’s Ultra MicroCap, compared to it’s competitor GMX (377Million).

That’s quite the spread. Mycelium is 62.83 times smaller than GMX.

The opportunity here is that, GMX alone cannot control the entire market share, if not 50%, let’s say at-least 30% will flood out to other exchanges.

There’s hardly any reliable ones with a similar trading model left. Say even 10%/30% of that capital finds it’s way to mycelium;

We’ll take the 10% of 62.83 for the sake of this example

(Also, we’ll assume that this “(x)times” of gains can be applied to the exchange/project the respective capital settles at;)

So, assuming 10% of that capital is heading to mycelium, by how much will mycelium’s MarketCap increase? And how much will the price of the MYC token increase?

Let’s solve this;

=> .10 * 62.83 = 6.283 times.

So assuming, we can multiply 6.283 * (MarketCap Of Mycelium)

=> 6.283*($6,171,823) = $38,777,563.909

Sidebar:

Here’s how we generally calculate the price of a Crypto Currency:

Market Cap of Cryptocurrency / Circulating Supply of Tokens.

Let’s take the new MarketCap value we got from our forecast of a “+6.283 times Hypothesis” and divide that with the a slightly higher circulating supply to take token inflation into consideration. That should print us a somewhat conservative but, perhaps realistic price forecast.

=> $38,77,563.909 / 500,000,000 MYC Tkns = $0.0775 (Current price $0.0125)

So, I Invested $50 and bought approx 3500 MYC tokens, my thesis is that this $50 investment will become $300 (623% Return) at some point in the future.

There you go, now you all know PonziNomics 101 as well as i do! 😉

Long-Story-Long (Bought 💸 some MYC & Staked 🥩 )

🪤 Outro

Of course, it goes without saying but bears repeating that nothing I say or share here is financial advice. I’m just another random individual starting a substack ‘cause I think I have something to share with you all’. 🤷

Also, like many individuals who are doing this for a living I also am a humble penniless fool. So, if you are a kind, bountiful, and gifted individual who has benefited from this S#!t Postery and wish to buy this S#!t Poster of yours a coffee, Some drip money would definitely be appreciated and will help to keep my fingers going on this mechanical keyboard of mine.

You can donate whatever you think is right at this address: shitcoinornot.eth :)