In the ever-evolving world of cryptocurrencies, a new narrative is unfolding. The East, led by Hong Kong, is embracing the crypto revolution with open arms, while the West, particularly the US, is struggling to keep pace.

I must begin by extending my sincerest apologies for my recent vanishing act during weeks 34 & 35. It appears that I had embarked on a journey, a quest if you will, that took me far away from my beloved wallet. And let's be honest, the markets were as still as a meditating monk, save for the frenzied dance of the MemeCoins.

This tale of two continents is not just about technological innovation, but also about regulatory environments, market dynamics, and the shifting global economic landscape.

As we delve into this fascinating story, we'll explore how Hong Kong is positioning itself as the de facto crypto hub, and why the West, despite its technological prowess, is falling behind.

📟 Disclaimer

I am not a financial advisor, and nothing I say in this substack is financial advice.

This is all educational content you can use as a starting off point for your own research initiatives. I’m just another random individual who started a substack ‘cause I think I have something to share with you all’. 🤷

That said, if you’d like to know a bit about me and are wondering why you should listen to me, read this intro post I wrote 🙌

🔭Macro Landscape: Asia’s Ascend

Alright, let's dive into the world of crypto, where the dragons of the East are breathing fire into the market, leaving the bald eagles of the West choking on their smoke.

May 24, 2023: Hong Kong, the city that never sleeps, especially when there's money to be made, announces that its Securities and Futures Commission (SFC) will start accepting applications for crypto trading platform licenses on June 1.

The SFC, not wanting to be the party pooper, agrees to let licensed virtual asset providers serve retail investors, but only if they promise to make sure their clients understand the risks involved.

Meanwhile, the SFC also decides that stablecoins, the crypto world's attempt at being a responsible adult, should not be admitted for retail trading until they've got their act together and are properly regulated. And as for crypto "gifts" designed to lure in retail customers, the SFC says, "Not on my watch!"

May 24, 2023: On the same day, South China Morning Post reports that despite the ongoing debate on whether crypto is a security or commodity, Hong Kong is throwing open its doors to the crypto industry. This move comes even as the US Commodity Futures Trading Commission (CFTC) and the US Securities and Exchange Commission (SEC) continue their sibling rivalry over how to classify cryptocurrencies.

May 24, 2023: Forkast.News chimes in with a report highlighting Hong Kong's potential as a leading hub for Web3, the blockchain-based evolution of the internet. The city has been attracting digital asset businesses with a range of initiatives, despite the strict regulations put in place to prevent a repeat of the Terra-Luna crypto project and FTX exchange collapses.

Crypto trading platforms like OKX and Bitget are lining up to apply for operation licenses in Hong Kong, while crypto data provider Kaiko and crypto exchange Huobi are packing their bags to move their Asia headquarters to Hong Kong from Singapore.

Vincent Chok, CEO of Hong Kong-based consultancy First Digital Trust, boldly declares, "Hong Kong will more than likely become not just Asia’s crypto hub, but the de-facto crypto hub globally."

Meanwhile, the US is still stuck in a regulatory quagmire, and Dubai, despite its ambitions, can't quite match Hong Kong's innovative spirit.

May 23, 2023: Coindesk reports that the SFC's new guidelines place a heavy responsibility on platform operators to conduct due diligence. The rules also require crypto exchanges to maintain at least 5,000,000 Hong Kong dollars ($640,00) in capital at all times and submit detailed financial reports to the SFC each month.

In conclusion, while the US is busy playing catch-up and dealing with regulatory paralysis, Asia, led by Hong Kong, is charging ahead in the crypto race. It's a classic tale of the tortoise and the hare, except this time, the hare is a dragon, and it's not planning on taking a nap anytime soon.

So, dear listeners, as we watch the US and the West fall further behind in the innovation race, let's remember the wise words of Confucius: "The man who moves a mountain begins by carrying away small stones." Or in this case, small Bitcoins.

Stay tuned for more updates from the wild, wild East of crypto!

🏦 Wallet Activity

This wallet review is a recurring post. The aim is to post an official update every Monday and see how far I can grow this little stash by week 52.

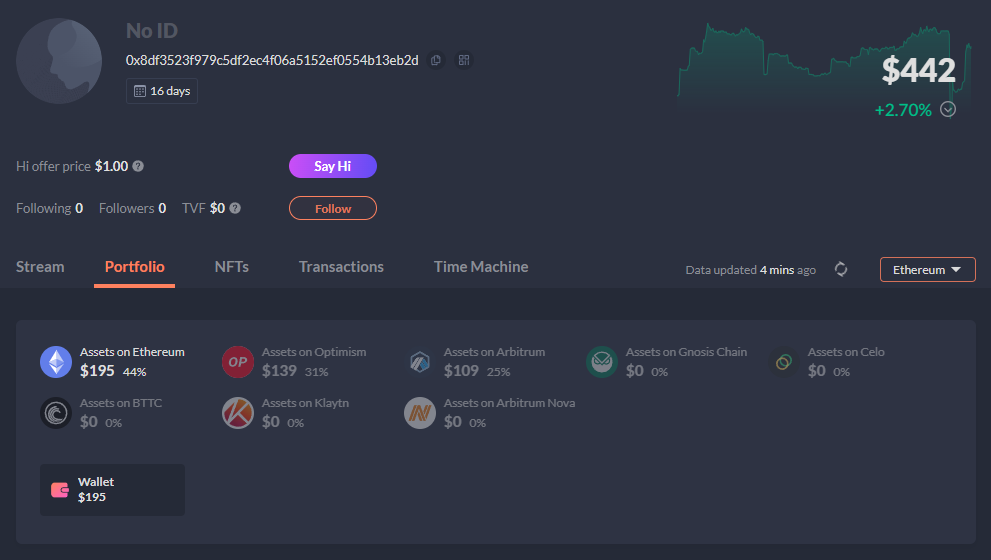

As of May 29th, 09:00 UTC this tiny stash of mine sits at a modest value of $3702 USD, dubbed week 36 closing balance & week 37 opening balance.

Week Zero(0) Opening Balance Was: $450

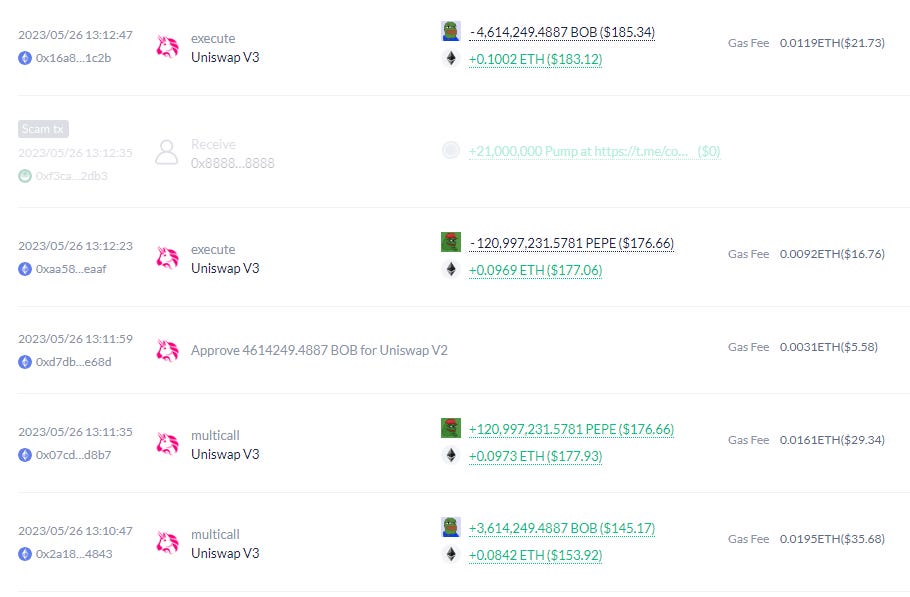

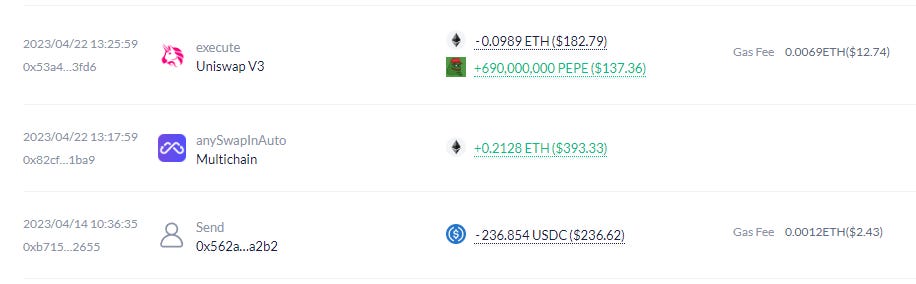

As the MemeCoin mania took hold, I decided to bid adieu to my Uniswap LP positions for BOB & PEPE, hoping to secure my profits like a squirrel stashing away nuts for the winter.

I withdrew about .21 ETH (Back in April) to dabble in the MemeCoin madness, and as of this moment, I'm sitting pretty with .46 ETH, netting me a tidy profit of approximately .25 ETH. And let's not forget the extra $100 I left frolicking in the PEPE/ETH & BOB/ETH Liquidity Pools.

While the masses were caught in the buy-sell whirlwind of MemeCoins, getting tossed around like a ship in a storm, we took a different route.

We put a small amount of capital on the line, anticipating high trading volumes and, consequently, high fees. We chose the LP route, capitalizing on the FOMO of others. A win-win situation, wouldn't you agree?

Sure, it's not a rags-to-riches tale or the kind of astronomical gains some folks have boasted during this MemeCoin mania. But let's be real, I'd choose a modest profit over massive losses or holding the bag any day of the week.

Could I have been more astute? Absolutely. Could I have paid more attention to MemeCoins? Without a doubt. Will I beat myself up over this? Probably not. After all, in the wild world of crypto, there's always another adventure just around the corner.

In a move as bold as a dragon guarding its hoard, I've decided to freeze this wallet for about six months. Why, you ask? Well, I believe the portfolio I've assembled has the resilience of a cockroach in a nuclear fallout, ready to survive and thrive over the next half a year. So, there's no need for me to play musical chairs with the assets here.

In a twist worthy of a spy thriller, I withdrew approximately $500+ and birthed a new wallet into existence: shitcoinoor.eth.

The purpose of this daring move? To reduce the risk of losing all my funds to a single mistake or phishing attack. After all, in the wild west of crypto, it's always better to be safe than sorry.

The mission for this new wallet is to take these funds and build and deploy on various networks.

You see, I've been as busy as a beaver, writing code, completing my Ethereum bootcamp, and learning to write FlashLoan Smart Contracts and MEV Bots. I believe this is the next frontier in my Crypto Journey.

While I will continue to speculate and dabble in ALT Coin and MEME Coins, my shitcoinornot.eth wallet will be as safe as a Swiss bank, away from my experimental wallet.

The aim here is to provide you, my esteemed audience, with a real-life example of segregating main wallets and branching off to secondary wallets once a wallet reaches a certain value.

For me, it was about securing 80% of my funds and speculating with the remaining 20%. Because in the world of crypto, it's all about balancing the thrill of the chase with the peace of a secure vault.

Conclusion 🔚

And so, dear readers, we find ourselves at the end of this thrilling saga. We've journeyed through the bustling crypto streets of Hong Kong, witnessed the rise of the East, and observed the struggles of the West.

We've danced with MemeCoins, navigated the stormy seas of market volatility, and emerged with modest profits and valuable lessons.

In the world of crypto, the only constant is change. Yet, amidst this whirlwind of innovation and speculation, the importance of strategic planning and risk management remains paramount.

As we've seen with the freezing of the shitcoinornot.eth wallet and the birth of shitcoinoor.eth, diversification and security are as crucial as ever.

As we continue to explore this fascinating landscape, let's remember that the journey is just as important as the destination.

Whether it's learning to code FlashLoan Smart Contracts, dabbling in ALT Coins, or simply observing the shifting dynamics of the global crypto landscape, every step is an opportunity for growth and discovery.

So, as we bid adieu to this chapter, let's look forward to the adventures that await us in the wild, wild East (and West) of crypto. Remember, in the words of the great Chinese philosopher Lao Tzu, "A journey of a thousand miles begins with a single step." Or in our case, a single Bitcoin.

Stay tuned, stay curious, and most importantly, stay safe in your crypto journey. Until next time, this is shitcoinornot.eth, signing off!

Disclaimer: These bold statements are for entertainment purposes only and should not be taken as financial advice or facts.

🐦Connect with Me:

For those of you who can't get enough of these crypto adventures and want to stay updated in real-time, feel free to follow me on Twitter.

You can find me under the handle @shitcoinoor. It's where I share my thoughts, insights, and the occasional meme about the wild world of crypto. Looking forward to connecting with you all in the Twittersphere!

🪤 Outro

Of course, it goes without saying but bears repeating that nothing I say or share here is financial advice. I’m just another random individual starting a substack ‘cause I think I have something to share with you all’.

Also, like many individuals who are doing this for a living I also am a humble penniless fool. So, if you are a kind, bountiful, and gifted individual who has benefited from this Shit Postery and wish to buy this Shit Poster of yours a coffee, Some drip money would definitely be appreciated and will help to keep my fingers going on this mechanical keyboard of mine.

Citations:

Hong Kong regulator to issue crypto licences with retail investor guardrails - Reuters, May 24, 2023

Hong Kong throws open the doors to cryptocurrency even as debate rages on whether it’s a security or commodity - South China Morning Post, May 24, 2023

The race is on for the Web3 hub of Asia - Forkast.News, May 24, 2023

Hong Kong Securities Regulator to Accept License Applications for Crypto Exchanges Starting June 1 - Coindesk, May 23, 2023

Share this post