Welcome back to the weekly s#!t post, where I break down the latest news and share my experiments with DeFi. In today's episode, we'll discuss the upcoming FOMC meeting, JPMorgan's acquisition of First Republic Bank, and the wild ride we experienced with Pepe Coin. Buckle up for an exciting and profitable journey!

📟 Disclaimer

I am not a financial advisor, and nothing I say in this substack is financial advice.

This is all educational content you can use as a starting off point for your own research initiatives. I’m just another random individual who started a substack ‘cause I think I have something to share with you all’. 🤷

That said, if you’d like to know a bit about me and are wondering why you should listen to me, read this intro post I wrote 🙌

What We’ll Be Discussing Today

Part 1: The FOMC Decision on Interest Rates

The upcoming May 3rd FOMC meeting has everyone on edge. Market participants expect the Fed to raise interest rates by 25 basis points and make remarks on further balance sheet runoffs.

Despite Powell's statement that rate cuts aren't in the base case, the bond market is pricing in three 25bps rate cuts by the end of 2023. With the debt ceiling deadline approaching, this FOMC meeting will be pivotal in determining the broad market direction. So, stay tuned!

Part 2: JPMorgan Acquires First Republic Bank

In a dramatic turn of events, JPMorgan has swooped in to save First Republic Bank, acquiring its assets and deposits after private rescue efforts fell short.

The acquisition has sparked discussions about the Biden administration's stance on consolidation in the financial industry. As JPMorgan's stock rises and First Republic's plunges, we'll keep our eyes on the unfolding story and its impact on the banking sector.

Part 3: Pepe Coin's Wild Ride

Now, let's take a look at our own investment journey with Pepe Coin. Last week, we shared our experiment in this peculiar cryptocurrency, and boy, did it pay off!

Our Pepe Coin investment has 5'xed, and we've cashed out, securing $578 in initial investment and profits. It just goes to show that sometimes taking a risk can lead to unexpected rewards.

🗺️ Macro Landscape

The FOMC Decision

Let’s dive into the Federal Reserve's upcoming May 3rd meeting and whether they'll raise interest rates, hit the pause button, or something else entirely. So, grab your popcorn and settle in for some monetary policy madness!

The FOMC Decision on Interest Rates The upcoming May 3rd FOMC meeting has everyone on edge.

The Main Event:

Market participants are eagerly awaiting the Fed's May 3rd meeting, with a 75% chance of a 25 basis point hike on the table.

If this happens, we'll see the terminal rate rise from 5% to 5.25%. But hang on to your hats, folks, because the bond market is predicting a pause in rate hikes come July and a rate cut in September.

The Balance Sheet Tango:

The Fed's massive $8.5 trillion balance sheet is also in the limelight, as investors await Jerome Powell's comments on balance sheet runoff.

Since last year, the Fed has been tightening the purse strings with a commitment of $95 billion per month in quantitative tightening (QT). Expect some verbal dancing from Powell on this front.

Plotting the Path:

Powell has made it clear that rate cuts aren't in the base case, but seven members see rates going even higher than the projected 5.1% terminal rate.

Meanwhile, the bond market is betting on three 25bps rate cuts by the end of 2023. So, who's bluffing?

Data-Dependent Dilemmas:

The Fed is notorious for being data-dependent, and recent releases have been a mixed bag.

Inflation is proving stickier than expected, with March CPI at 5% and core CPI at 5.6%. On the other hand, strong labor force numbers and a resilient economy signal that the US is still in fighting shape.

Debt Ceiling, Financial Conditions, and Yield Curve Drama:

As the debt ceiling deadline looms on June 5th, US credit default swaps are skyrocketing, indicating that investors are getting antsy.

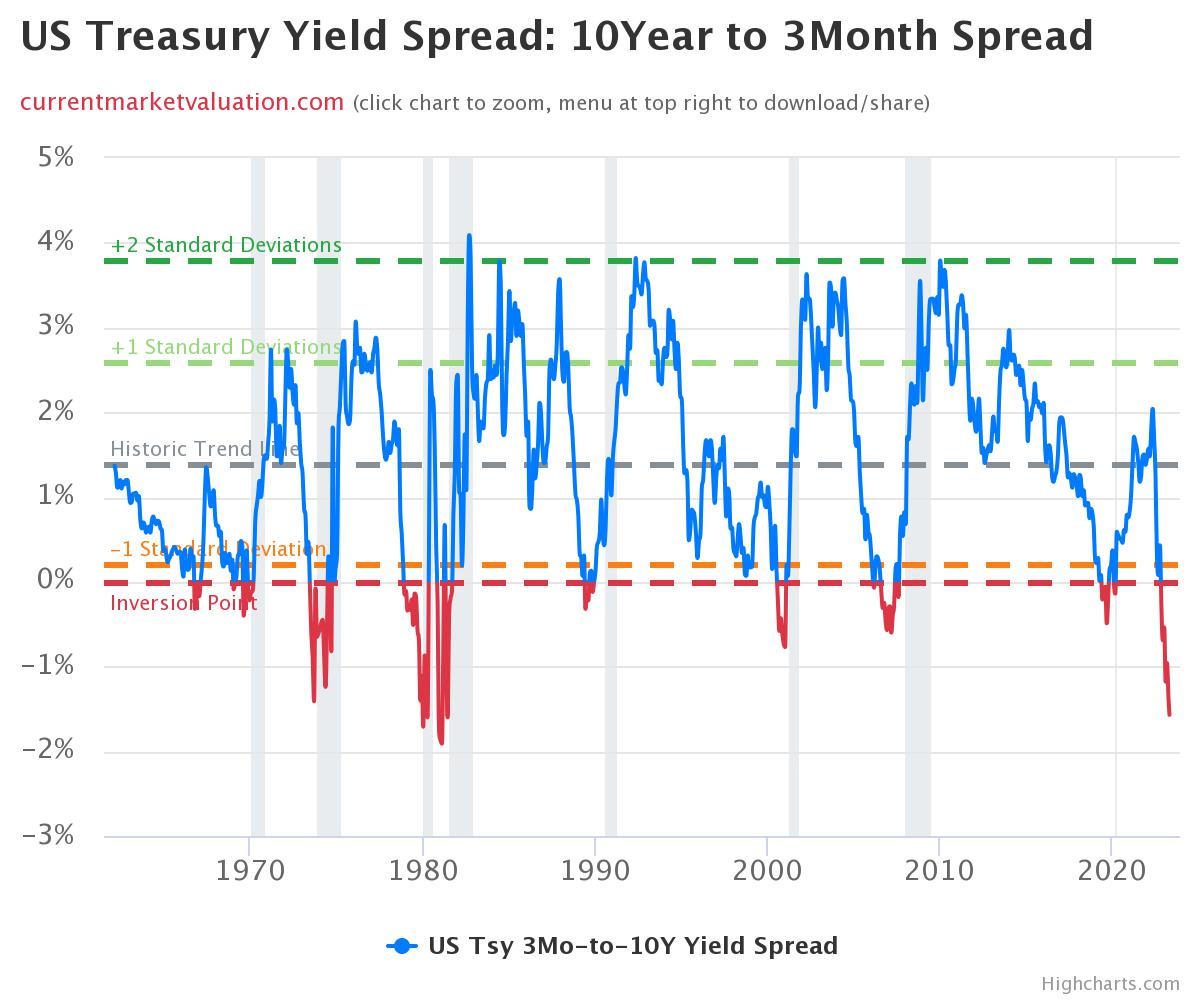

Meanwhile, financial conditions have tightened since April, which is music to Powell's ears. However, an inverted yield curve between 3M/10YR suggests that we could be on the brink of a recession.

Conclusion:

The upcoming May 3rd FOMC meeting is shaping up to be a financial thriller. Watch out for Powell's tone and statements on further QT signals, as the outcome will set the stage for the market's direction in the coming months. Will it be higher for longer or a pause? Grab your popcorn, folks, we're in for a wild ride!

Yet Another Bank Collapses and Bites the Dust

The Rescue: JPMorgan has swooped in to save First Republic Bank, acquiring its assets and deposits after private efforts failed to plug the lender's balance sheet hole. JPMorgan and the Federal Deposit Insurance Corp. (FDIC) agreed to share the burden of losses and recoveries on single-family and commercial loans.

Why It Matters:

JPMorgan's rescue of First Republic highlights the bank's financial strength and ability to act quickly in times of crisis.

This acquisition makes JPMorgan, already the nation's largest bank, even more gargantuan. However, it raises questions about the Biden administration's stance on consolidation in the financial industry.

The Impact:

First Republic's shares plunged over 33%, while JPMorgan's rose 3.8%. JPMorgan estimates a one-time gain of $2.6 billion tied to the transaction, with $2 billion in restructuring costs expected over the next 18 months.

The bank has promised to repay the $30 billion it and other large US banks provided to First Republic in March to stabilize its finances.

The Loss-Sharing Agreement:

JPMorgan and the FDIC will share both losses and potential recoveries on $173 billion in loans and $30 billion in securities.

This includes $50 billion worth of five-year, fixed-rate term financing. The FDIC estimates the cost to the deposit insurance fund at around $13 billion.

The Bigger Picture:

First Republic Bank's troubles, including rising interest rates and fleeing depositors, highlight the challenges faced by regional lenders.

The bank's downfall serves as a cautionary tale for others in the industry and a reminder of the importance of strong capital requirements and an effective resolution framework.

🏦 Wallet/Portfolio Review:

This wallet review is a recurring post. The aim is to post an official update every Monday and see how far I can grow this little stash by week 52.

As of May 1st, 09:00 UTC this tiny stash of mine sits at a modest value of $4049 USD, dubbed week 29 closing balance & week 30 opening balance.

Week Zero(0) Opening Balance Was: $450

Now, let's dive into our own investment journey with Pepe Coin. Last week, we shared our experiment in this peculiar cryptocurrency, and we're excited to share the results. Hold on to your seats as we walk you through the thrilling ride we experienced with Pepe Coin!

The Investment:

We took a chance on Pepe Coin, a relatively unknown cryptocurrency, as part of our ongoing exploration into the world of digital assets. To give you a transparent view of our journey, we've provided screencaps of our DeBank profile and EtherScan links to show the details of our transactions.

The Payoff:

To our delight, our Pepe Coin investment paid off big time! Within a week, the value of Pepe Coin skyrocketed, reaching 5 times its initial value.

With a keen eye on the market and a sense of perfect timing, we decided to cash out, securing $578 in both our initial investment and profits. It just goes to show that sometimes taking a risk can lead to unexpected rewards. (Not Financial Advise Of course, i just got lucky, simple as that).

I had also opened up an ETH/PEPE Uniswap LP pool and within a week it has yielded $80 in fees collected. As it stands right now, I have no incentive to liquidate this pool so I’ll likely let this run a little longer and support the PEPE community.

Lessons Learned:

Our Pepe Coin adventure serves as a valuable lesson in the world of cryptocurrency investing. It highlights the importance of being open to exploring lesser-known assets, understanding market trends, and knowing when to cash out.

While not every investment will yield such impressive returns, our experience with Pepe Coin demonstrates that taking calculated risks can indeed pay off.

🪤 Outro

That's a wrap for today's episode! We've covered the anticipation surrounding the FOMC meeting, JPMorgan's daring rescue of First Republic Bank, and our exhilarating Pepe Coin adventure.

Of course, it goes without saying but bears repeating that nothing I say or share here is financial advice. I’m just another random individual starting a substack ‘cause I think I have something to share with you all’. 🤷

Also, like many individuals who are doing this for a living I also am a humble penniless fool. So, if you are a kind, bountiful, and gifted individual who has benefited from this S#!t Postery and wish to buy this S#!t Poster of yours a coffee, Some drip money would definitely be appreciated and will help to keep my fingers going on this mechanical keyboard of mine.

Share this post