The world of global finance is often a mysterious and complicated place, governed by a small group of individuals who wield tremendous power over the global economy.

The recent decision by the U.S. Federal Reserve to raise interest rates by 25 basis points and drop language suggesting further rate increases has left many wondering what the future holds for the world's financial markets.

📟 Disclaimer

I am not a financial advisor, and nothing I say in this substack is financial advice.

This is all educational content you can use as a starting off point for your own research initiatives. I’m just another random individual who started a substack ‘cause I think I have something to share with you all’. 🤷

That said, if you’d like to know a bit about me and are wondering why you should listen to me, read this intro post I wrote 🙌

Post May FOMC Meeting Landscape

Despite concerns over the unfolding U.S. banking crisis, Fed Chair Jerome Powell remains optimistic that the economy will avoid a recession this year.

However, market watchers are split on what the Fed's next move will be, with some expecting a pause in June and others predicting possible rate cuts in the second half of the year.

Goldman Sachs sees the recent Fed decision as supportive of their call for a pause in June, but acknowledges that the statement was less definitive than expected.

Meanwhile, Bank of America Global Research believes that the Fed has reached its terminal rate in this tightening cycle, but leaves open the possibility of a rate hike in June depending on economic factors.

Morgan Stanley believes that the Fed's recent statements hint at a pause and sees the effects of banking stresses on the economy as highly uncertain.

They expect the Fed to remain on hold before making the first 25bp cut in March 2024. Barclays predicts that the Fed will maintain the funds rate target range at 5.00-5.25% through the rest of the year, assuming that economic activity will slow gradually and turn into a mild recession in the second half of the year.

As these conflicting viewpoints suggest, the future of the global economy remains uncertain.

However, one thing is clear: the rise of cryptocurrencies and blockchain technology has the potential to disrupt traditional finance in a major way.

As investors seek to diversify their portfolios and protect against inflation, cryptocurrencies may offer an attractive alternative to traditional assets.

But as with any investment, caution is key. The world of crypto can be volatile and unpredictable, and it's important to do your due diligence before diving in. Nonetheless, the growing interest in crypto suggests that it may play an increasingly important role in the global economy in the years to come.

Looking Ahead : May 10th is Inflation Data Release

Now, we all know that inflation has been a hot topic lately, and for good reason. The Fed wants to see inflation coming down, but it's not happening as quickly as they'd like. And that's where the CPI report comes in.

According to the Cleveland Fed's nowcasts, we can expect to see a 0.5% month-on-month increase in core CPI for April, which could keep annual inflation at over 5%. Not great news for the Fed, but it's not all doom and gloom.

May's monthly increase is forecast at 0.3%, and combined with sharply rising prices from May 2022 falling out of the series, we could finally see annual CPI drop below 5% for the first time since 2021. Plus, high month-on-month inflation from June 2022 rolling out of the 12-month series the following month could help bring down inflation even further.

But let's talk about the elephant in the room – housing costs. Shelter costs make up a majority of the CPI's importance weighting in calculating U.S. price trends, and they've been on the rise. However, industry data from Redfin suggests that median U.S. home prices may be falling year-on-year, which could bring down the overall inflation reading. We haven't seen that yet, but it's something to keep an eye on.

So, what does this all mean for the Fed? Well, they're set to hold rates at high levels for the rest of 2023, partly due to their belief that inflation will remain high. But the bond markets aren't convinced they'll stay the course. Currently, the markets expect the Fed to hold rates steady at their June meeting, but there's a chance they could make another small hike if inflation comes in well above expectations.

However, there's also a good chance the Fed will be cutting rates by September or even July, but that would only happen if inflation is trending significantly lower or if there's some weakening in the U.S. economy, perhaps through the jobs market.

So, there you have it – a quick rundown of what to expect from May's CPI report. It may not be the most exciting topic, but it's definitely one to keep an eye on.

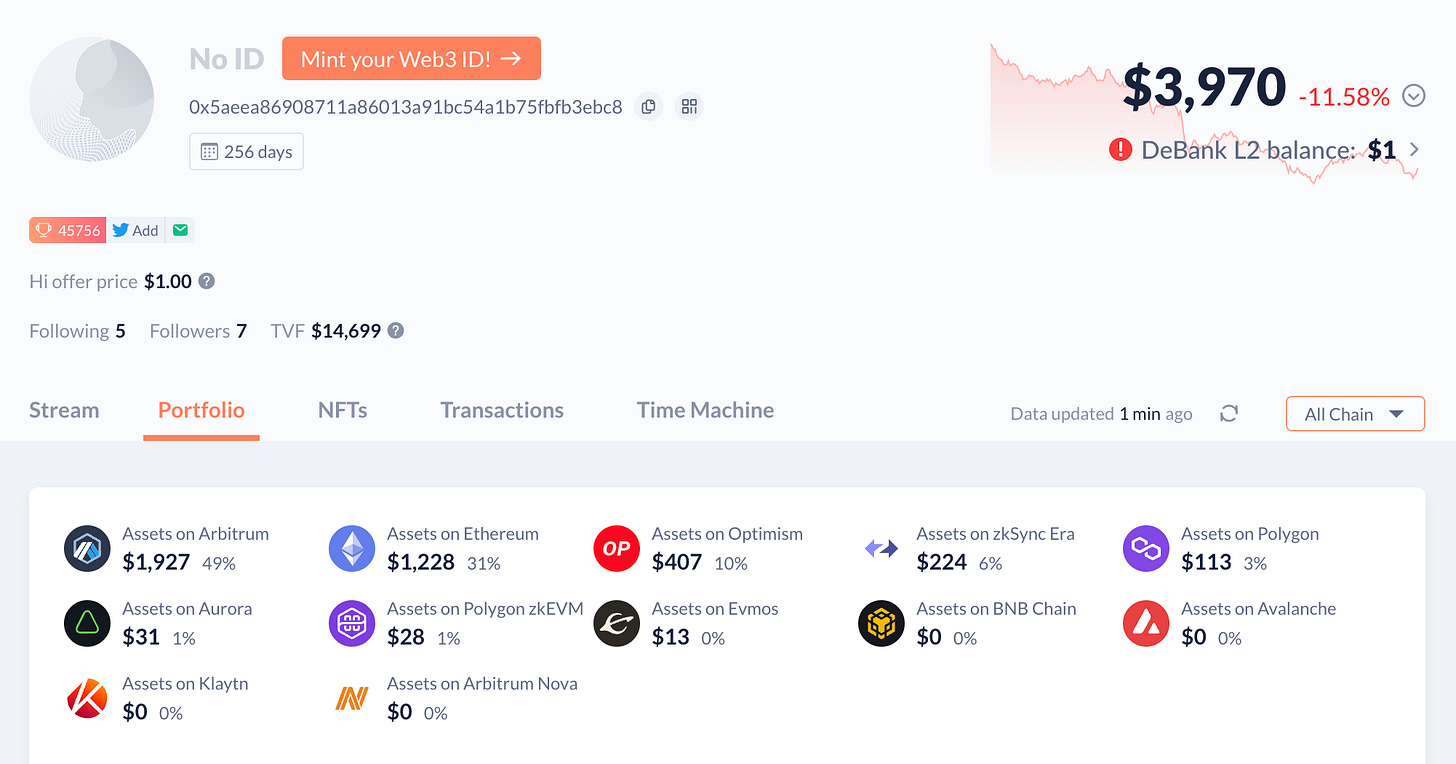

Wallet Activity

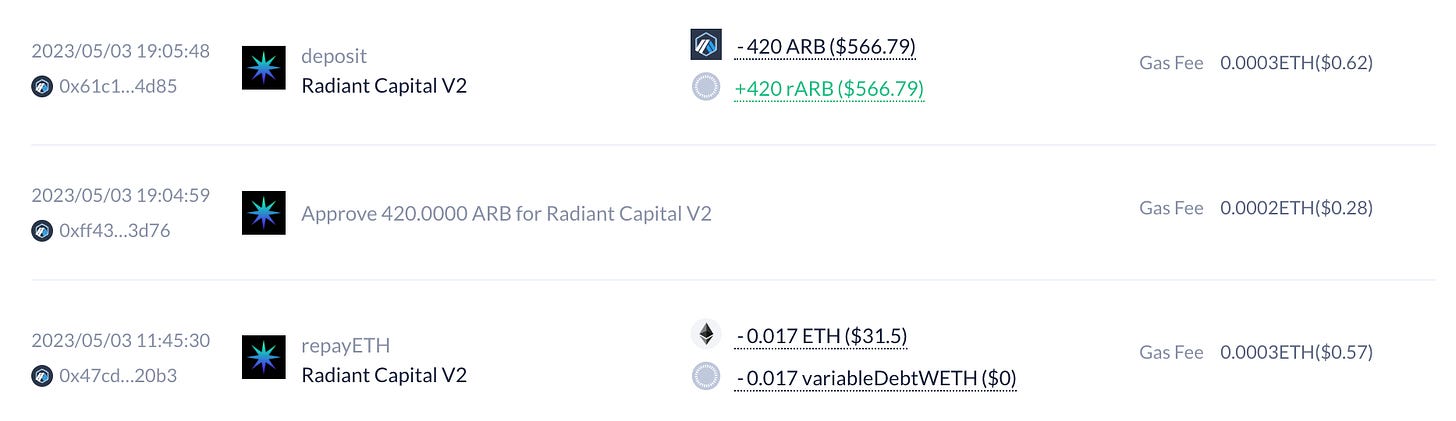

On May 3rd, I used Radiant Capital V2 to repay 0.017 ETH and 0.017 variableDebtWETH. Later that day, I deposited 420 ARB on Radiant Capital V2.

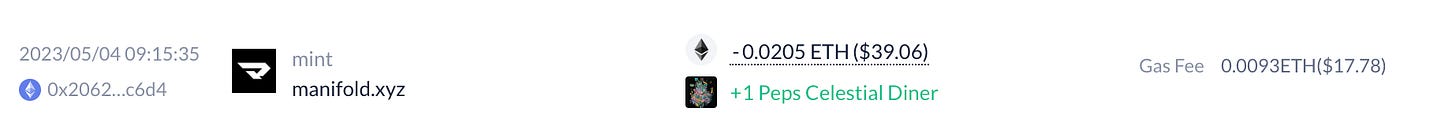

On May 4th, I minted Peps Celestial Diner on Manifold.xyz by sending 0.0205 ETH and paid a gas fee of 0.0093 ETH.

I started experimenting with a new dAPP called Gamma.xyz

On May 5th, I executed an order on Uniswap V3, exchanging 0.0195 ETH for 6.3526 GNS and paid a gas fee of 0.0003 ETH.

Later that day, I used Gamma to deposit 0.0106 WETH and 11.2673 GNS, then approved 0.0106 WETH and 11.2673 GNS for Gamma.

Also on May 5th, I deposited 28.415 USDC and 40.4073 OP on Gamma, then approved 41.5942 USDC and 40.4073 OP for Gamma.

On May 6th, I withdrew 77.2379 brahPOLYV2 and deposited 78.4117 WMATIC, paying a gas fee of 0.1062 MATIC. As i figured my experiments with this protocol had run their course.

Finally, my meme coins (PEPE & BOB) had yielded me significant gains and collected fees, so I decided to claim those fees and secure some profits.

However, this turned out to be an unwise decision, as evident from the transaction log above, where I ended up paying over $100 in gas fees just to use the Ethereum mainnet.

In retrospect, I should have held off on trading this week, as I overtraded and moved around too much due to fear of short-term trends.

In conclusion, managing a personal cryptocurrency wallet can be a challenging task. It requires careful planning, research, and a deep understanding of the various protocols and platforms involved.

While there are potential profits to be made, it is also important to weigh the risks involved and make informed decisions.

In the case of my recent wallet activity, I realized that I made some mistakes that cost me in terms of fees and missed opportunities.

Going forward, I plan to take a more measured approach and be more mindful of the fees involved in each transaction. Ultimately, the key to success in managing a cryptocurrency wallet is to remain informed, disciplined, and patient.

If you enjoyed this whirlwind of finance and crypto news, make sure to subscribe to my podcast or Substack blog for more insights and stories. Until next time, happy investing!

disclaimer: These bold statements are for entertainment purposes only and should not be taken as financial advice or facts.

🪤 Outro

Of course, it goes without saying but bears repeating that nothing I say or share here is financial advice. I’m just another random individual starting a substack ‘cause I think I have something to share with you all’.

Also, like many individuals who are doing this for a living I also am a humble penniless fool. So, if you are a kind, bountiful, and gifted individual who has benefited from this Shit Postery and wish to buy this Shit Poster of yours a coffee, Some drip money would definitely be appreciated and will help to keep my fingers going on this mechanical keyboard of mine.

Share this post