For decades, the U.S. dollar has reigned supreme as the global currency of choice. However, a shift is underway as cryptocurrencies and BRICS nations, including the Chinese Yuan, emerge as viable alternatives.

As a neutral and unbiased finance and crypto blog, My aim is to bring you the latest news and insights into this ongoing battle for the throne of the global monetary system. Join me as I explore the factors driving the shift towards cryptocurrencies and alternative currencies, the challenges they face, and the potential implications for the future of finance.

📟 Disclaimer

I am not a financial advisor, and nothing I say in this substack is financial advice.

This is all educational content you can use as a starting off point for your own research initiatives. I’m just another random individual who started a substack ‘cause I think I have something to share with you all’. 🤷

That said, if you’d like to know a bit about me and are wondering why you should listen to me, read this intro post I wrote 🙌

👛 Wallet Summary

This wallet review is a recurring post. The aim is to post an official update every Monday and see how far I can grow this little stash by week 52.

As of April 17th, 12:00 UTC this tiny stash of mine sits at a modest value of $4029 USD, dubbed week 30 closing balance & week 31 opening balance.

Week Zero(0) Opening Balance Was: $450

What’s this de-dollarization thing i’ve been hearing lately?

Hold onto your hats folks, because Brazil and China are “coming closer together” and they're ready to take on the world! Celso Amorim, Brazil’s Chief Adviser on Foreign Policy, recently spoke with China’s Global Times and discussed the de-dollarization of trade.

Amorim stressed the importance of not being reliant on a single currency, especially one that could be used politically, and instead suggested that working with a basket of currencies is the way to go.

China and Brazil have already agreed to trade in their respective currencies, rather than using the US dollar.

They’re also part of the BRICS group, which is made up of Brazil, Russia, India, China, and South Africa, and is reportedly working on creating a new form of currency to shift away from the US dollar even further.

Amorim believes that this move towards de-dollarization could help build a more multipolar world, in which power is less centralized and there is no hegemony.

He also stressed the importance of Brazil and China’s strategic partnership and how it could lead the way for developing countries to cooperate more closely.

It seems like Brazil and China are ready to take on the world and build a less centralized future.

Maybe they should create a superhero duo: The Brazilian Bullet and the Chinese Crusher! Okay, maybe that’s a bit much, but you get the point. It’s time to move away from reliance on a single currency and towards a more balanced world.

↪️ Last Week’s Recap:

📉 CPI Data

The US Consumer Price Index (CPI) increased 5% from a year earlier in March, the smallest annual gain since May 2021.

Inflation slowed for a ninth straight month in March amid drops in both gasoline and grocery prices. The CPI also rose 0.1% on a monthly basis, resuming a previous downshift.

However, core prices, which exclude volatile food and energy items, increased 0.4% from February, indicating a long-term upward trend.

The report shows that goods inflation is somewhat easing, but prices for services are rising more sharply.

Rent continues to be the biggest driver of inflation, up 8.8% in the past year. The cost of groceries declined 0.3%, but is still up 8.4% annually. Gasoline prices declined 4.6% in March and are down 17.4% from a year ago.

🔌 ETH Shanghai

Once upon a time, in the land of Ethereum, there was a great transition happening. The people were moving from a proof-of-work to a proof-of-stake consensus, which is basically like trading in your old jalopy for a shiny new sports car. It's a big deal.

Now, some folks were worried that this transition would be bad news for ether (ETH), the cryptocurrency of the Ethereum network. But lo and behold, a new upgrade called "Shapella" arrived on the scene and answered that question with an emphatic "NO" (kind of like when your mom asks if you've been eating cookies before dinner).

And the market was pleased! ETH was trading at over $2,000, which is nothing to sneeze at. The upgrade allowed stakers of ETH to withdraw their staked deposits, which meant more liquidity and more opportunities to earn staking rewards.

And what about ETH's Relative Strength Index (RSI)? Well, it's risen to 69 (nice!), which is its highest level since January. That's like hitting a home run in the bottom of the ninth inning!

Of course, not everyone was convinced. Some investors were worried that this rush of liquidity would lead to a run on the Ethereum network. It was like a scene out of a western movie, with bulls and bears standing on opposite sides of a double swinging door, ready to draw their pistols at a moment's notice.

But in the end, the bulls had the upper hand. The prospect of staking rewards was too tempting, and many investors decided to stay put. In fact, 18.3 million ETH (worth a cool $36 billion) is currently staked, with approximately 1.1 million in ETH rewards that investors could un-stake and sell for a profit.

Now, this is where things get interesting. If everyone decided to un-stake and sell, the price of ETH could drop faster than a hot potato. But if investors decide to re-stake those profits, it could be a different story. So far, net deposits have declined slightly, but it's too soon to say what the future holds.

So there you have it, folks. The story of Shapella and the great Ethereum transition. Will it be a happy ending? Only time will tell. But for now, let's enjoy the ride and hope for the best.

📟 Portfolio Activity Review

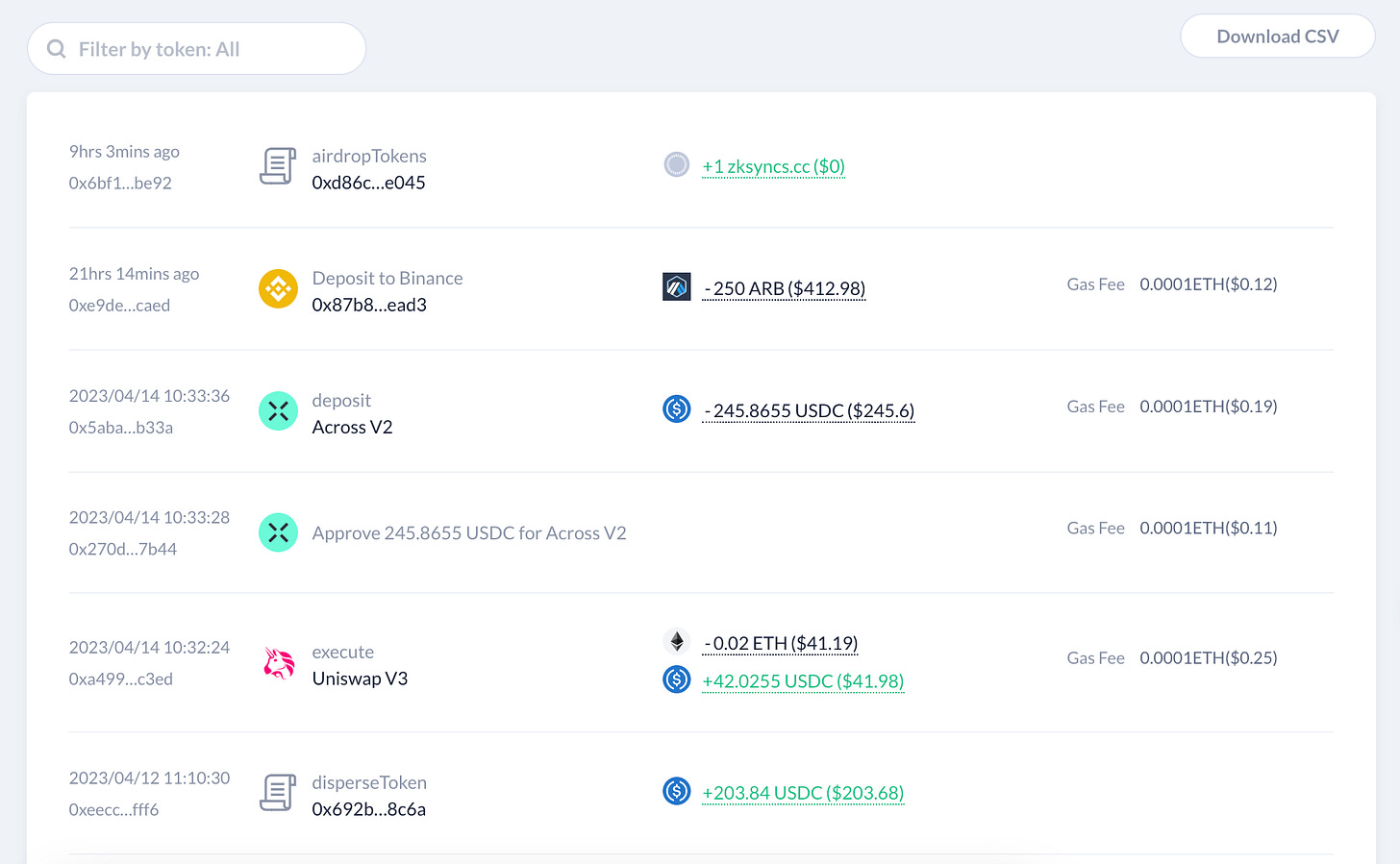

Honestly, all I did this week was secure some profits and withdraw almost all of my initial investment of around $900 (I had already taken out $200 in the previous weeks).

As you can see in my transaction log above, I received $200 from Vela.exchange's VLP, which turned out to be on its "mainnet-beta" phase.

They closed the pools and returned the funds to the respective wallets, which unfortunately left me with $10 less than what I initially invested.

It wasn't the best way to start the week, and I was a bit caught off guard by Vela's sudden move. But, as an OG contributor and tester of their dApp/service with real liquidity, I'm hopeful that this will lead to some kind of economic reward or airdrop in the future.

Anyway, I decided to swap some of my ETH, around $42 worth, and transferred all of the USD $245 to mainnet to off-ramp the USDC to my bank account. That way, I could afford some rice, ramen, and my rent, of course!

A day or two later, ARB reached fresh highs, so I thought it was a good idea to take some profits from the ARB airdrop for myself. I figured I might as well withdraw my entire initial investment and completely de-risk.

Now, with the capital that I've accumulated since November 2022, I can keep building these profits into bigger and bigger ones. Who knows? Maybe one day I'll be able to afford sushi instead of just rice and ramen!

As it stands right now, I'm not eyeing any new investments, but here's what I'm expecting could happen over the next few months.

We have likely completed some form of macro markdown phase and are in an accumulation-mark-up phase.

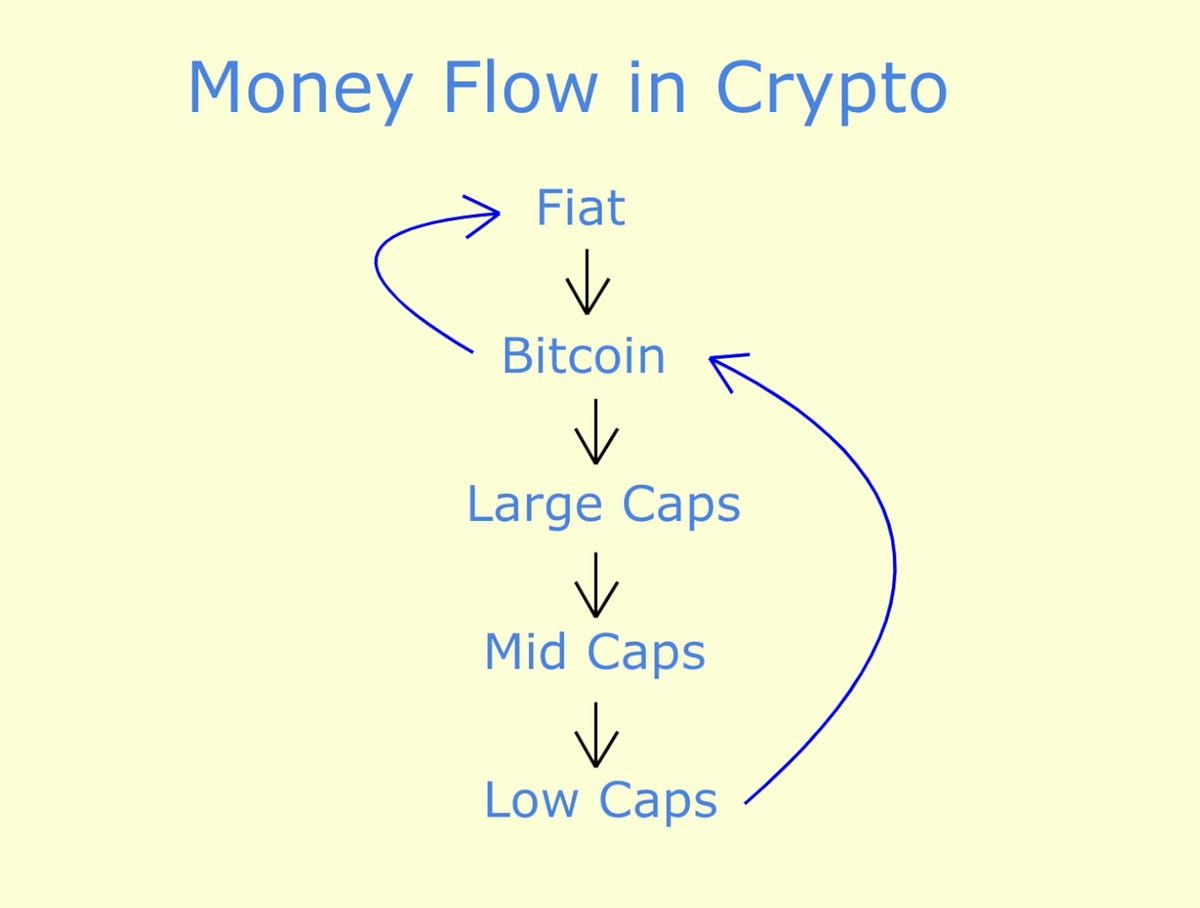

Fresh liquidity first enters BTC, then slowly trickles down to ETH, large caps, mid caps, and small/micro caps, until it all eventually gets cycled back to BTC, ETH, and stables.

It's like a never-ending cycle of liquidity flowing in and out of the market, with different cryptocurrencies taking turns as the primary focus of investor attention.

Of course, this is just my opinion based on my experience and knowledge of the market. Crypto is always full of surprises, so who knows what will happen next? One thing's for sure, though - it's never a dull moment in this space.

🪤 Outro

Of course, it goes without saying but bears repeating that nothing I say or share here is financial advice. I’m just another random individual starting a substack ‘cause I think I have something to share with you all’. 🤷

Also, like many individuals who are doing this for a living I also am a humble penniless fool. So, if you are a kind, bountiful, and gifted individual who has benefited from this S#!t Postery and wish to buy this S#!t Poster of yours a coffee, Some drip money would definitely be appreciated and will help to keep my fingers going on this mechanical keyboard of mine.

Share this post