📟 Disclaimer

I am not a financial advisor, and nothing I say in this substack is financial advice.

This is all educational content you can use as a starting off point for your own research initiatives. I’m just another random individual who started a substack ‘cause I think I have something to share with you all’. 🤷

That said, if you’d like to know a bit about me and are wondering why you should listen to me, read this intro post I wrote 🙌

👛 Wallet Review

This wallet review is a recurring post. The aim is to post an official update every Monday and see how far I can grow this little stash by week 52.

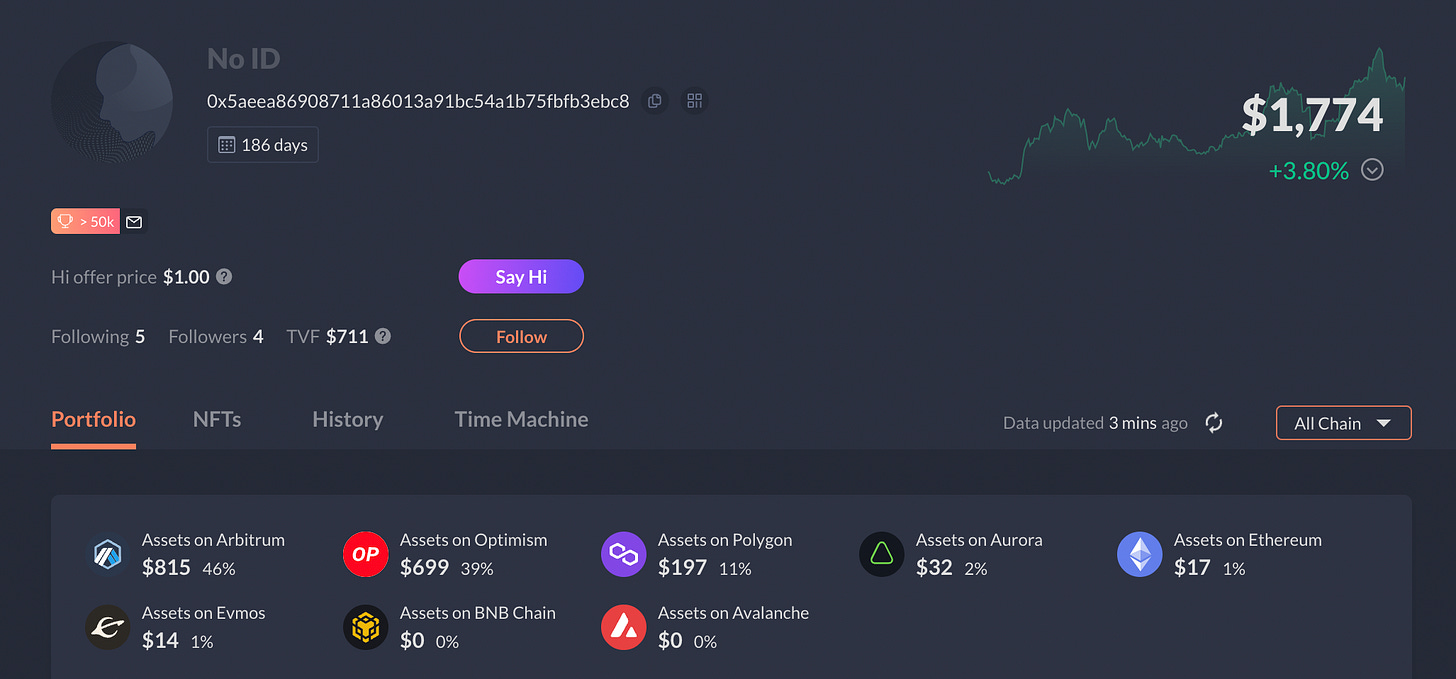

As of February 27th, 12:00 UTC this tiny stash of mine sits at a modest value of $1774.00 USD, dubbed week 22 closing balance & week 23 opening balance.

Week Zero(0) Opening Balance Was: $450

🤝 Coinbase’s BASEd Chain!

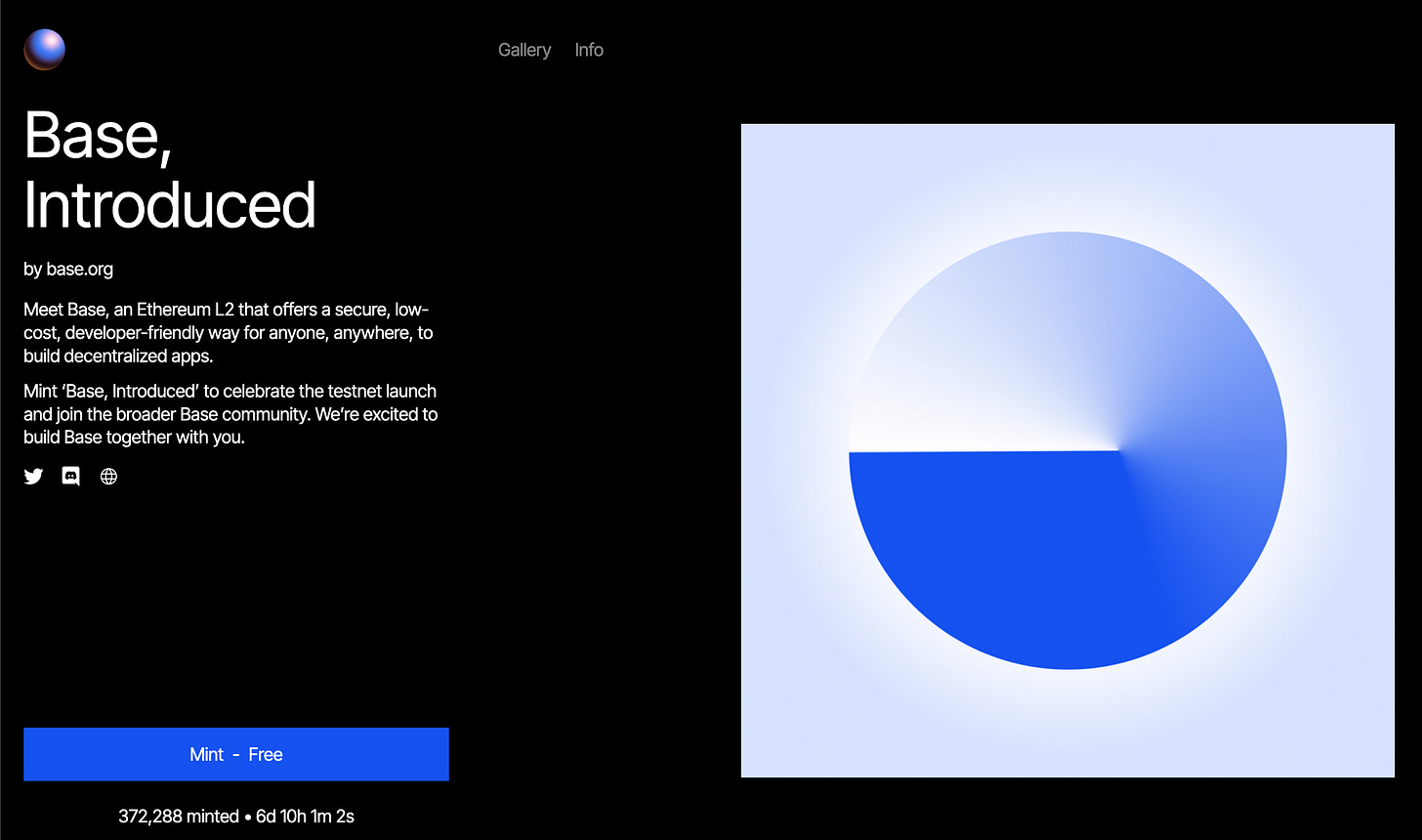

Coinbase, has announced the launch of its Ethereum Layer 2 (L2) network, called Base. Base will offer secure, low-cost, and developer-friendly decentralized applications for Ethereum.

The L2 network is built on the OP Stack, making it decentralized, open, and permissionless.

Coinbase will join OP Labs and the Optimism Collective to create a robust ecosystem of interoperable L2s and rollups that will onboard the next billion users into web3.

The collaboration aims to create a mesh or super-chain of many rollups to scale Ethereum, and it will make the crypto-economy more affordable for mainstream users.

Coinbase will contribute a percentage of its transaction fees to the Optimism Collective to fund public goods infrastructure.

The goal is to make web3 more accessible to a greater number of people and accelerate the development and decentralization of the OP Stack and Superchain.

Wen BASE/COIN Token?

It’s important to highlight that there will be no BASE or COIN token, at-the-very-least, not as of yet! Folks can try out the test-net and mint an “Innaugeration NFT of sorts”

If You are a Builder trying to build on the BASE-Chain and would like to tap into some grants and ecosystem funding COINBASE has made available for builders, you can sign-up on the forum here

Gary Boi - Part II

Nepotism Rarely Makes Up for Lack Of Talent

Crypto lawyers are firing back at the Securities and Exchange Commission (SEC) Chair Gary Gensler's recent claim that every cryptocurrency, except Bitcoin, falls under the agency's jurisdiction as a security.

In a New York Magazine interview, Gensler claimed that every cryptocurrency except Bitcoin is a security that falls under the SEC's jurisdiction.

However, lawyers argue that Gensler's opinion is not the law, and judges ultimately determine legal meaning and application, not SEC chairs.

Gabriel Shapiro, the general counsel at investment firm Delphi Labs, added that the SEC would have to file a lawsuit against each token creator, which is seemingly impossible given the number of tokens and their value.

This lack of regulatory clarity and hypocrisy from the SEC has been criticized by the crypto community.

“What is the plan here? Since registration is not feasible, it can only be [that] everyone pays huge fines, stops working on the protocols, destroys all dev premines, and delists [tokens] from trading. That would mean 12,305 lawsuits.”

It seems like the SEC needs to do some more research before making blanket statements about crypto regulation. Maybe they should start by taking a crash course in Crypto 101!

It is no secret that North America has been lagging behind in innovation and risks becoming obsolete if regulatory policies continue to hinder progress. (Times. 2019).

While the East is making strides in decentralized finance, the West is too busy catering to their "Too Big to Fail" banks.

Rumors have been circulating that Goldman Gary, aka Gary Gensler, had undisclosed meetings with FTX's Sam Bankman-Fried and gave special treatment that allowed for the exchange's exponential growth.

No matter how you dice-it & slice-it, Goldman Gary played a part in the FTX collapse and is now making reactionary comments to cover up his mistakes.

As a random observer, it's frustrating to witness the nepotism prevalent in American traditional finance and politics. However, It has been bittersweet to watch the West self-sabotage since 2020, and the changing world order is a real concern. If we're not careful, we could easily become victims of the circumstances created by these “global elites”.

💰State of My Wallet & Assets

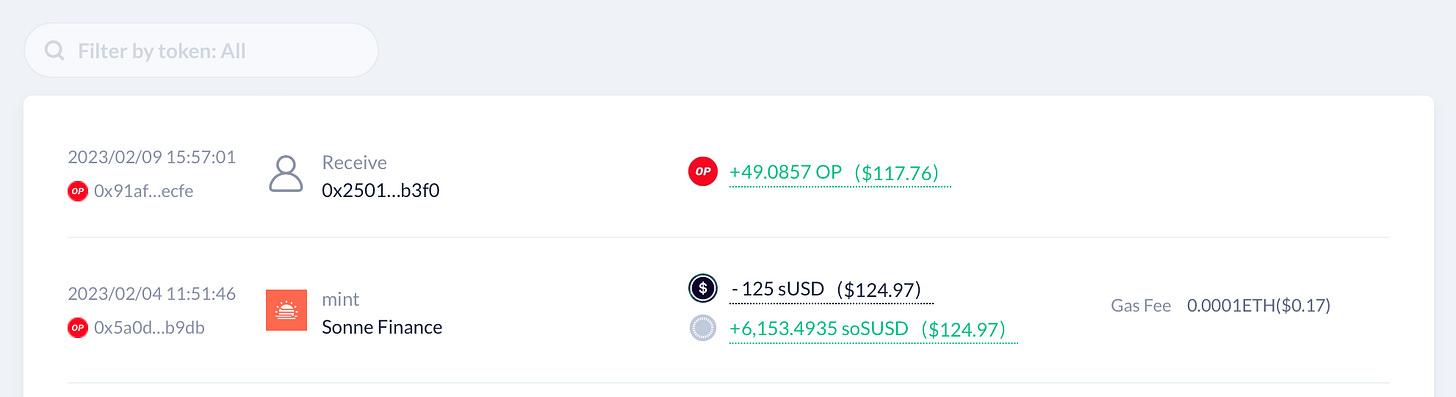

As evident from the transaction log displayed above, I have not executed any transaction since February 4th, except for the one related to the OP season 2 airdrop on February 9th.

Therefore, I am content with the assets I presently hold and see no need for any alterations to my portfolio. I remain confident in my investment choices.

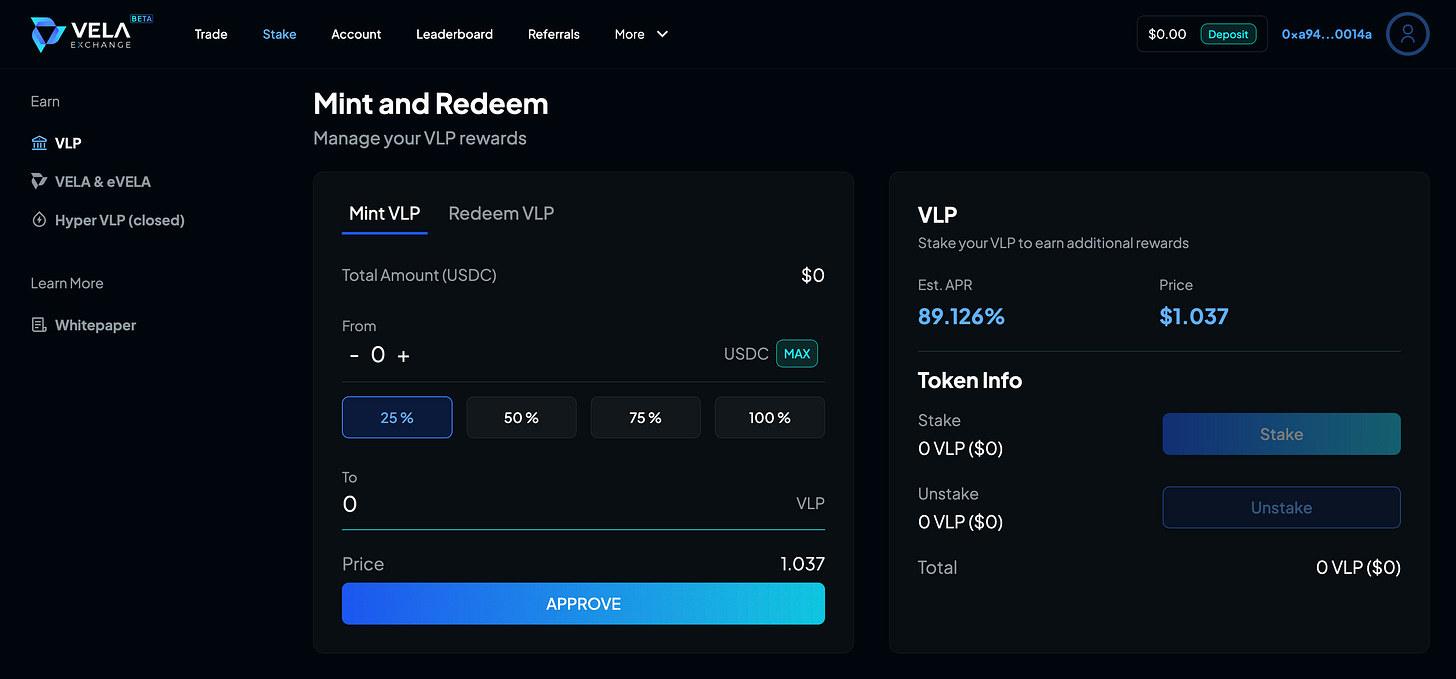

However, that doesn't mean I haven't been considering any new investments. Recently, someone recommended vela.exchange on Arbitrum, which not only has great fundamentals but also promising pumpamentals.

As it stands, I will likely convert my sUSD that's been sitting in the Sonne Finance pool to USDC, mint some VLP, and start earning some esVELA instead of just buying and holding the token.

I believe this will be a good passive strategy to grow my cash stash, help bootstrap liquidity for a new up-and-coming protocol, and earn some rewards in the process.

Apart from that, there's not much else to report for this week. The state of the market feels stagnant, and most participants seem to be in a wait-and-see mode.

At the beginning of the year, it seemed more likely that inflation was dropping like a rock, but now there may be chances that it could prove to be more sticky than initially anticipated.

Having said that, the FOMC has been slow to react for as long as time itself has existed. There isn't a larger group of under-qualified, out-of-touch-with-reality individuals controlling the global reserve currency.

The M2 supply was a precursor and a leading indicator of the coming inflation. You cannot just print 40% of the entire supply and blame labor and war for inflation. The hypocrisy and lack of ownership with these entitled individuals are appalling, but such is the nature of the world we live in.

Disclaimer: This above bold statements are for entertainment purposes only and should not be taken as financial advice or facts.

🪤 Outro

Of course, it goes without saying but bears repeating that nothing I say or share here is financial advice. I’m just another random individual starting a substack ‘cause I think I have something to share with you all’. 🤷

Also, like many individuals who are doing this for a living I also am a humble penniless fool. So, if you are a kind, bountiful, and gifted individual who has benefited from this S#!t Postery and wish to buy this S#!t Poster of yours a coffee, Some drip money would definitely be appreciated and will help to keep my fingers going on this mechanical keyboard of mine.

Share this post