📟 Disclaimer

I am not a financial advisor, and nothing I say in this substack is financial advice.

This is all educational content you can use as a starting off point for your own research initiatives. I’m just another random individual who started a substack ‘cause I think I have something to share with you all’. 🤷

That said, if you’d like to know a bit about me and are wondering why you should listen to me, read this intro post I wrote 🙌

👛 Wallet Review

This wallet review is a recurring post. The aim is to post an official update every Monday and see how far I can grow this little stash by week 52.

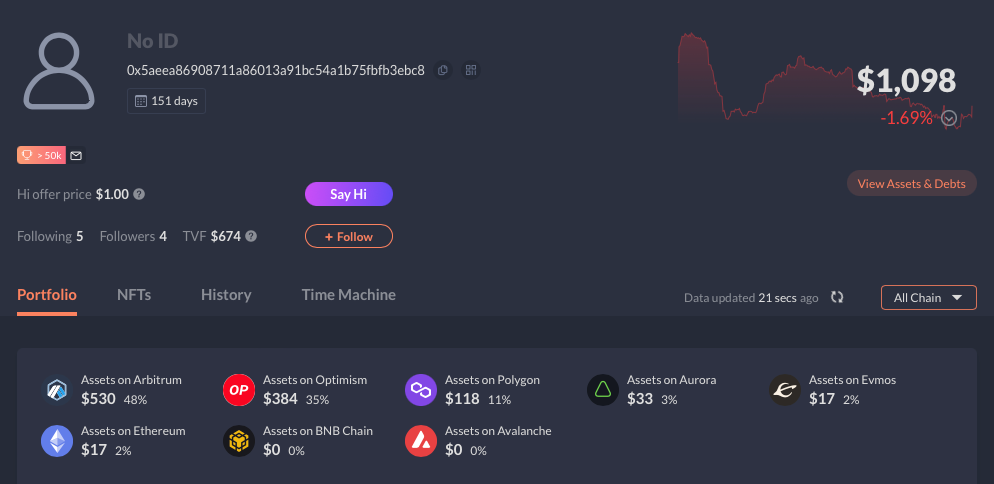

As of January 23rd, 09:00 UTC this tiny stash of mine sits at a modest value of $1098 USD, dubbed week 17 closing balance & week 18 opening balance.

Week Zero(0) Opening Balance Was: $450

I won't be going through all of my investments in detail in order to keep this review succinct, engaging, and free of repetition. I will only be covering my activity over the last week!

I advise you to review the posts from the previous week and evaluate how this "experiment" is going.

🤔Was this a trend reversal or merely a relief rally?

Similar to the stock market, the cryptocurrency market is susceptible to trend reversals and relief rallies.

A trend reversal in the cryptocurrency market occurs when the market's general direction switches from rising to falling or from falling to rising.

This can occur after a considerable amount of time, and it may indicate that a significant market change is going to occur.

A relief rally, on the other hand, occurs when the cryptocurrency market briefly increases after a prolonged period of down.

This may occur following a significant market decline, and it may indicate that the market is beginning to rebound. It does not, however, imply that the market's general course has changed.

Because both of these entail the cryptocurrency market rising, a novice investor may mistake these two concepts.

However, in order to make better choices, it's critical to comprehend the distinction between the two as well as the market catalysts that may have an impact.

It might not be a good idea to buy now, for instance, if you see a relief rally taking place because the market may still continue to fall.

To secure profits from the recent price surge, traders might sell into a relief rally. Another concern is that the market might not continue its upward trend because relief rallies are frequently fleeting.

Technical analysis can also be used by traders to spot resistance levels where the price of the cryptocurrency is expected to face selling pressure and sell into the rally before it hits such levels.

As you can see in the daily chart of Bitcoin's price above, the cryptocurrency has been in a downtrend since June 2022.

However, there is a positive sign as the volume has increased significantly, indicating that participants are returning to the market. While this is a positive sign, it's not necessarily cause for celebration just yet.

The indicators StochRSI, RSI and MACD are all approaching overbought levels. It's important to note that reaching the overbought level doesn't mean the move is over and that prices will drop significantly. However, a reset of sorts for a healthy uptrend continuation is not unlikely.

It's difficult to say for certain whether this is a trend reversal or simply another bear market relief rally/bull-trap.

However, if I were to give it odds, I would say there's a 60% chance that this is a relief rally, giving favourable prices for the upcoming billions in VC unlocks/vesting schedules.

On the other hand, there's a 40% chance that this is a trend reversal, as we have broken a previous high and could potentially be forming a macro bottom structure, similar to previous bear markets.

🔍 2018-2019 Bear market

🤔What are my plans for the upcoming volatility?

To be completely transparent, I did take advantage of the relief rally and sold some of my positions to secure profits. I then reinvested those profits into opportunities that I believe will be less affected by the upcoming volatility in the market.

One of those positions (Radiant Capital) has pretty much doubled.

As you can see in the transaction log above, my entire investment in Radiant capital was as follows on January 14th 2023:

61.29 + 48.38 + 7.74 = 117.41 (As of January 14th).

Today January 23rd, Approx. 10 days later this has jumped up to $213 (Approx. $95 profit) it actually went as high as $280 mid-week and the price has been correcting ever since.

Last week, I did not make any new transactions and therefore, there is nothing new to report. As of now, I feel relatively confident in my current positions.

It's important to remember that investing in the crypto market can be risky, and it's always good to have a strategy in place.

By taking profits and reinvesting them in opportunities that may be less affected by volatility, you can potentially mitigate risk while still having the opportunity to earn returns.

Additionally, being patient and not making any hasty decisions during market fluctuations can also be beneficial.

📣 Weekly Highlights/Drama:

‘Wtf is Bitzlato?’ Crypto Twitter rolls eyes at DOJ’s big arrest:

Looks like the US Department of Justice (DoJ) was having a little kicky being a little tricky with 4th grader techniques (which I guess is a massive improvement for them).

The US DOJ just learned a valuable lesson in how NOT to manage expectations on Crypto Twitter. They teased an "international crypto enforcement action" for an exchange starting with the letter ‘B’ and suddenly, the price of Bitcoin and other cryptocurrencies took a nosedive!

The crypto community was in a frenzy, speculating on who might be the next target (Coughs *binance* Coughs), with many on tenterhooks due to the recent collapse of the FTX crypto exchange.

But hours later, the DoJ announced that they had arrested the Russian founder of a tiny Hong-Kong based crypto exchange called Bitzlato on money laundering charges.

The crypto community was left scratching their heads, asking "Bitzlato? Never heard of it."

But the DoJ proudly declared it as a "significant blow to the cryptocrime ecosystem" , Bitcoin price immediately reversed its slide and the crypto community erupted in memes.

Lesson learned, DoJ. Next time, just stick to the facts and save us all from a crypto heart attack.

Genesis Claims $5.1B in Liabilities in First-Day Bankruptcy Filing

Genesis, a crypto lending firm, held $5.1 billion in liabilities in the weeks following its freeze on withdrawals last November, according to bankruptcy court documents.

Three of its entities - Genesis HoldCo, Genesis Global Capital LLC and Genesis Asia Pacific PTE. LTD - filed for Chapter 11 bankruptcy protection.

The firm was caught up in the fallout of FTX's implosion and customers demanded Genesis repay $827 million in loans, forcing its lending units to freeze withdrawals.

Additionally, Genesis' parent company Digital Currency Group (DCG) and its subsidiaries were also impacted by the market turmoil and did not have the liquidity to pay back the company on certain loans, adding pressure to the balance sheets.

This was further compounded by a $1.2 billion loss to crypto hedge fund Three Arrows Capital (3AC) which collapsed in the summer of 2022.

Genesis joins BlockFi, Voyager and Celsius, among others, in filing for bankruptcy that can be traced back to the collapse of terraUSD (UST)-luna ecosystem in May which vaporized tens of billions of dollars in capital.

Asset Managers ‘Licking Their Chops’ Over Potential GBTC Takeover

Source: Blockworks

An online campaign advocating to strip Grayscale Investments from management duties of its Bitcoin Trust (GBTC) has gained support from roughly 2,600 investors who own 153 million or 22% of GBTC shares.

Among the campaign's goals are offering a path to redemptions for GBTC investors, reducing the trust's management fees, and ensuring a competitive bidding process for potential new GBTC sponsors.

The trust has been under fire in recent months as its discount has hovered in the 40% range and reached as high as nearly 50%.

Grayscale's parent company is Digital Currency Group (DCG) which also owns Genesis, which filed for bankruptcy last week.

Hedge fund Fir Tree Partners and crypto investment firm BlockTower are among the institutions that have reached out to the campaign.

More firms are expected to come forward with proposals in the coming weeks, including crypto-focused companies and traditional finance firms.

🪤 Outro

Of course, it goes without saying but bears repeating that nothing I say or share here is financial advice. I’m just another random individual starting a substack ‘cause I think I have something to share with you all’. 🤷

Also, like many individuals who are doing this for a living I also am a humble penniless fool. So, if you are a kind, bountiful, and gifted individual who has benefited from this S#!t Postery and wish to buy this S#!t Poster of yours a coffee, Some drip money would definitely be appreciated and will help to keep my fingers going on this mechanical keyboard of mine.

The last Domino?